Determining the financial value of a particular entity, be it a business, asset, or individual, is a complex endeavor. Establishing a firm understanding of a person's or entity's net worth requires careful consideration of various factors.

Ascertaining the financial worth of an individual or entity often entails evaluating assets and liabilities. Assets, which represent ownership, encompass a wide range of items, including cash, investments, real estate, and tangible possessions. Liabilities, conversely, represent obligations or debts owed. Subtracting total liabilities from total assets yields a measure of net worth. The process can be straightforward for simple cases, but becomes increasingly intricate for complex entities or individuals with sophisticated financial portfolios.

Understanding an individual's net worth can be crucial for a variety of purposes. For instance, it's essential for lenders when assessing creditworthiness. In business, it reflects the financial health and stability of a company. Furthermore, it is a critical factor in many legal matters, inheritance, and other financial dealings. Historical context plays a role; economic conditions, inflation, and market fluctuations all affect evaluations.

| Category | Description |

|---|---|

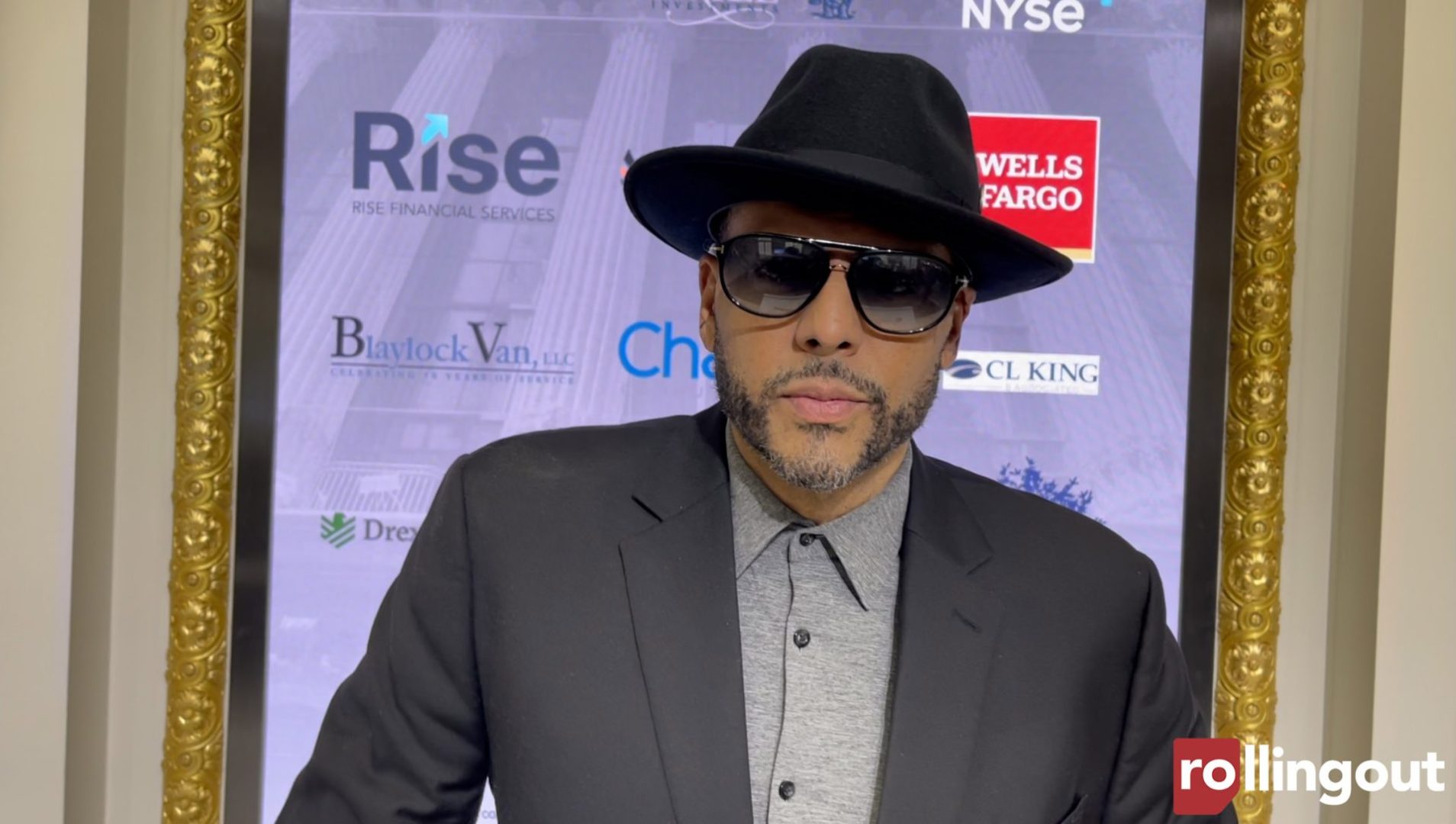

| Name | Al B Sure |

| Profession | (Placeholder - Could be musician, entrepreneur, athlete, etc.) |

| Location | (Placeholder - City, State/Country) |

| Further Information | (Placeholder - Additional background/details of this person or entity, if needed) |

Without specific information about "Al B Sure," a precise valuation is impossible. To determine a potential net worth, detailed financial records are necessary. This article would now proceed to discuss the methodologies involved in such valuations, including different approaches for various types of entities.

How Much Is Al B Sure Worth?

Determining the net worth of any individual necessitates a comprehensive evaluation of various factors. This involves assessing assets, liabilities, and other financial considerations.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Valuation Methods

- Public Information

The worth of "Al B Sure" hinges on verifiable assets. These could include real estate holdings, investments, and cash. Liabilities, such as outstanding debts or loans, diminish net worth. Income streams and expenses further shape the financial picture. Investments like stocks, bonds, or cryptocurrency impact total value. Various valuation methods exist, each with unique parameters. Public information, like company filings or social media presence, could provide insight, yet these are often incomplete. Ultimately, determining an exact figure requires detailed financial records, an often inaccessible resource without transparency.

1. Assets

Assets directly influence the calculation of an individual's net worth. Understanding the nature and value of assets is fundamental to determining "how much is Al B Sure worth." Assets represent ownership of valuable items or resources, and their valuation is a key component in financial assessments.

- Tangible Assets

Tangible assets have a physical presence. Examples include real estate (homes, land), vehicles, and personal possessions (jewelry, collectibles). Appraisals and market values are crucial in determining their worth. Fluctuations in market conditions, local property values, and the condition of the asset itself significantly affect their evaluation. The precise value of these assets, especially unique or antique items, often relies on specialized appraisals.

- Financial Assets

Financial assets represent ownership in various forms, such as stocks, bonds, mutual funds, and bank accounts. Their value depends on market conditions, the financial health of the issuing company (in the case of stocks and bonds), and overall economic trends. Investment performance, dividends, and interest earned play a substantial role in the overall financial picture. Precise calculation hinges on current market valuations.

- Intellectual Property

This category encompasses creations with inherent value, like patents, copyrights, or trademarks. The value of intellectual property can be considerable, especially in industries where innovation is crucial. Determining this value requires specialist valuations and often hinges on future earning potential and market acceptance. Factors like licensing agreements and ongoing maintenance of intellectual property rights significantly affect valuation.

- Intangible Assets

These assets lack a physical form but still possess monetary value, for example, brand recognition, customer goodwill, and a strong reputation within a particular field. Assessing the precise monetary value of intangible assets can be complex, as their worth is frequently tied to earning capacity and future potential. Factors such as customer loyalty and market demand impact their evaluation.

Collectively, understanding the nature and value of these various asset categories is essential for fully grasping the concept of "how much is Al B Sure worth." Accurate valuation depends on reliable data and expert assessment. Accurate appraisal necessitates attention to current market conditions, recent performance trends, and potential future growth projections.

2. Liabilities

Liabilities directly influence the calculation of net worth. They represent existing debts or obligations. Understanding the extent of these financial commitments is crucial for accurately determining "how much is Al B Sure worth." Liabilities act as a counterpoint to assets, diminishing the overall value. For example, a substantial mortgage on a property reduces the net worth tied to that asset. Similarly, outstanding loans, credit card debt, or unpaid taxes reduce the value of the individual's overall financial standing.

The impact of liabilities on net worth is demonstrably significant. A high level of debt can seriously erode an individual's net worth. For instance, if Al B Sure has substantial outstanding debts or loans, the calculated net worth will be significantly lower than if comparable assets existed without corresponding liabilities. This is particularly true when liabilities surpass the value of assets. Conversely, a low level of debt contributes positively to net worth, reflecting a stronger financial position. A prudent approach to borrowing and managing financial obligations plays a pivotal role in building and maintaining a healthy financial standing.

In conclusion, liabilities are a crucial component of any net worth calculation. Ignoring or underestimating these obligations can lead to inaccurate assessments. A comprehensive understanding of liabilities is essential for evaluating the overall financial health and position of an individual, such as "Al B Sure," and for making informed decisions about future financial choices and strategies. Recognizing the relationship between liabilities and net worth provides a clearer perspective on the true financial standing and allows for informed decisions about financial planning and risk management.

3. Income

Income directly impacts the net worth of an individual. It's a fundamental factor in building and maintaining financial stability. Income, representing the flow of earnings, acts as a primary driver in accumulating assets and, conversely, in reducing liabilities. Regular, consistent income allows for the accumulation of savings, investments, and the eventual reduction of debts. The amount and regularity of income significantly influence the potential for increasing net worth over time. A higher, stable income stream typically correlates with a greater capacity to amass assets, ultimately leading to a higher net worth.

Consider an individual, similar to "Al B Sure," with multiple income streams. A musician earning royalties from music streams, alongside income from concert performances, possesses a more complex income profile than a salaried employee. The musician's earnings from various sources streams, performances, and merchandise contribute to their total income, which significantly affects their net worth potential. Conversely, a person reliant on a single, stable salary may find their net worth growth more predictable and potentially slower. The variability and diversification of income sources play a crucial role in determining the overall impact on net worth. Real-world examples demonstrate how consistent income, whether from a salaried position or diverse income streams, allows for investment, debt repayment, and the gradual increase in overall net worth. This principle applies across various professions and economic backgrounds. The consistent flow of income directly enables the accumulation of assets, creating the basis for increasing net worth.

In conclusion, income is a vital component in determining net worth. A clear understanding of income sources, their consistency, and their variability provides a framework for comprehending the potential for wealth accumulation. Income's role in net worth emphasizes the importance of financial planning, diversification of income streams, and responsible financial management. This understanding is crucial for both individuals and businesses in their respective financial strategies.

4. Expenses

Expenses directly impact an individual's net worth. They represent the outflow of funds for various necessities and desires. High expenses, regardless of income, can hinder the accumulation of assets and thus the growth of net worth. Expenses need careful consideration and management alongside income to determine the true financial position. An individual with significant expenses relative to their income might experience challenges in accumulating wealth. Conversely, efficient expense management allows for the allocation of resources towards investment opportunities and debt reduction, thereby contributing positively to net worth. Understanding and controlling expenses is instrumental in creating a financial roadmap for enhancing net worth over time.

Expenses manifest in numerous forms. Housing costs, including rent or mortgage payments, represent a substantial portion of many budgets. Utilities, groceries, transportation, and healthcare are other significant expenditure areas. Additional expenses might include entertainment, personal care items, and recurring subscriptions. The interplay between expense levels and income determines the overall financial situation. For example, an individual with a high-paying job but substantial expenses may not see significant net worth growth. On the other hand, a person with a modest income but highly controlled expenses might see their net worth increase steadily over time. This illustrates the critical importance of managing expenses effectively. The specific nature of expenses varies based on individual lifestyle, location, and needs. A homeowner in a high-cost area faces different expense realities compared to someone renting in an affordable city. This necessitates tailored financial strategies for each individual's circumstance. The ability to control and prioritize expenses is a crucial factor in achieving financial goals and contributing to a positive net worth trajectory.

In conclusion, expenses are inextricably linked to net worth. Managing expenses effectively, aligning spending with income, and prioritizing financial goals are crucial for long-term financial success. Strategic expense management becomes a critical component in achieving financial stability and the gradual enhancement of net worth. Understanding this connection allows individuals to make informed financial decisions, align their expenditures with their objectives, and build a sustainable path towards wealth creation. Without prudent expense management, any individual, regardless of income, faces the risk of hindering their net worth growth.

5. Investments

Investments play a pivotal role in determining an individual's net worth. Investment decisions significantly influence the growth or decline of accumulated capital. The nature and performance of investments directly impact the overall financial standing, and therefore the answer to "how much is Al B Sure worth." Successful investment strategies contribute to a higher net worth, whereas poor choices can lead to losses and a decrease in overall financial value. For instance, successful investments in stocks, real estate, or other assets can generate returns that accrue to the individual's wealth and subsequently increase their net worth. Conversely, poorly timed or poorly executed investments can diminish capital, lowering net worth.

The significance of investments lies in their potential to generate returns exceeding the initial investment amount. These returns, whether through dividends, interest, or appreciation in asset value, contribute to the growth of wealth. A diversified portfolio of investments, encompassing various asset classes, generally mitigates risks associated with fluctuations in any single market. For example, a portfolio combining stocks, bonds, and real estate can provide a balance, potentially minimizing the impact of market downturns in one sector on the overall investment performance. The choice of investment vehicles directly correlates to the overall risk tolerance and financial goals of the investor. Strategies for investment management, including diversification, risk assessment, and regular monitoring of portfolio performance, are crucial for sustained growth and preservation of capital. The selection of appropriate investment strategies can be a differentiating factor between modest and substantial wealth accumulation, ultimately influencing "how much is Al B Sure worth."

In conclusion, investments are a critical component in understanding and determining an individual's net worth. Strategic investment decisions and sound investment management strategies are crucial for long-term financial success and accumulating wealth. The impact of investments, and their interplay with income, expenses, and asset management, forms the foundation of a robust financial profile. An understanding of the different investment avenues and their inherent risks and rewards is essential for individuals seeking to maximize their financial potential. By comprehending the principles of investment, individuals can proactively manage their wealth and make informed choices that directly influence the overall answer to the question of "how much is Al B Sure worth."

6. Valuation Methods

Determining the precise worth of an individual like "Al B Sure" necessitates the application of specific valuation methods. These methods provide a structured approach to evaluating assets and liabilities, facilitating a comprehensive assessment of overall financial standing. The chosen method significantly impacts the final valuation. For example, a simple estimation might suffice for a person with limited assets, while a complex evaluation is crucial for individuals with intricate financial portfolios encompassing diverse investments, real estate holdings, and potential intellectual property. The selection of a suitable valuation method is crucial, as the outcome directly influences the final figure. This is especially critical in financial planning, legal proceedings, and other situations demanding a clear estimation of financial worth.

Several valuation methods exist, each with unique considerations. For tangible assets like real estate, appraisal methods based on comparable sales or cost approaches are frequently used. Financial assets, such as stocks and bonds, utilize market values or discounted cash flow analysis to estimate their worth. The chosen approach often depends on the nature of the asset, market conditions, and the desired level of accuracy. Furthermore, factors like the condition of the asset, economic climate, and market trends influence the application of each method. If the focus is on a musician's value, for example, a royalty stream analysis might be employed, reflecting the potential future earnings. If determining the value of an entrepreneur's company, a business valuation model would be necessary, possibly employing methods based on comparable company analysis or discounted cash flow. Each valuation method offers specific benefits and constraints. Consequently, understanding these differences is paramount for ensuring a comprehensive and accurate determination of worth. The chosen approach directly influences the resultant estimate, demonstrating the direct connection between valuation methods and the outcome of such calculations.

In summary, the selection and application of appropriate valuation methods are indispensable in establishing "how much is Al B Sure worth." The process demands careful consideration of various factorsasset types, market conditions, and the intended purpose of the valuation. The choice of method directly correlates to the accuracy and reliability of the final result. Without a methodologically sound valuation approach, the resultant figure might be misleading or inaccurate. Therefore, a thorough understanding of different valuation methods and their specific applications is crucial for a reliable assessment of financial worth, whether for an individual or a complex entity. Consequently, meticulous attention to these specific methodologies becomes integral in ensuring a sound and credible estimation of financial worth for various practical applications.

7. Public Information

Public information plays a significant role in estimating the worth of an individual like "Al B Sure." Its availability and accuracy directly impact the reliability of any valuation. Information publicly accessible, such as financial disclosures (if available), can offer insights into assets, liabilities, income sources, and investment patterns. For example, publicly available financial records of a company owned or significantly involved with by "Al B Sure" might detail stock holdings or significant transactions. Similarly, information on public appearances, endorsements, or brand mentions (e.g., in media), can offer clues to brand value and potential income streams if such activities exist. However, the absence of such information doesn't preclude a valuation, but it limits the precision and depth of the estimate.

The importance of public information extends beyond direct financial disclosures. Information regarding industry affiliations, professional accolades, and public recognition can also contribute to the assessment. For instance, awards received by "Al B Sure" might indicate achievements and potentially higher earning potential, influencing market perception and brand strength. News articles, press releases, or social media presence offer glimpses into reputation and public perception, which, in turn, are often considered when assessing an individual's overall worth. While such indicators are not direct financial measures, they can furnish vital context. Crucially, any public information must be carefully scrutinized to avoid biases, inaccuracies, or misinterpretations. Comparisons to similar public figures or companies within the same sector offer a wider framework for understanding potential worth. Real-world examples abound where public information significantly influences estimations. For example, stock market valuations often rely heavily on publicly reported company performance data.

In conclusion, public information, though not definitive, is a crucial component in understanding "Al B Sure's" worth. Its availability, accuracy, and comprehensiveness directly impact the precision of any valuation. While public information cannot provide a complete picture, it furnishes valuable context and insight. The challenges lie in the potential for incomplete or biased data, the need for careful interpretation, and the understanding that public recognition isn't synonymous with financial worth. Nevertheless, public information is an essential element in the process of determining the relative worth of an individual or entity in the context of financial estimation.

Frequently Asked Questions About Net Worth

This section addresses common inquiries regarding the determination of an individual's net worth, focusing on the complexities and limitations of such estimations. Information presented is intended to provide clarity and context, not precise figures.

Question 1: How is net worth calculated?

Net worth is calculated by subtracting total liabilities from total assets. Assets encompass various forms of ownership, including cash, investments, property, and other valuables. Liabilities represent debts or obligations. This process, while straightforward in principle, becomes intricate for individuals with complex financial portfolios. Accurate calculation relies on detailed financial records and professional valuation methods.

Question 2: What factors affect an individual's net worth?

Several factors influence net worth, including income streams, investment returns, expenses, and market conditions. The consistent flow of income allows for asset accumulation and debt reduction. Conversely, significant expenses can hinder wealth building. Investment performance and market fluctuations can significantly impact the value of assets. The totality of these factors forms the overall financial profile, impacting the individual's net worth.

Question 3: Is public information sufficient to determine net worth?

Public information, such as financial disclosures or media appearances, can offer some insights, yet it is insufficient for precise net worth determination. Public information often provides only a partial view of an individual's financial picture, lacking crucial details about assets and liabilities. It is essential to recognize that public perceptions or reputation do not equate to precise financial worth.

Question 4: What are the limitations of estimating net worth?

Estimating net worth presents inherent limitations. Valuing certain assets (e.g., intellectual property, intangible assets) can be complex. Market fluctuations and economic conditions can impact asset values. The availability of comprehensive financial records is also crucial but not always accessible. Consequently, any estimate must be viewed with appropriate context, acknowledging these limitations.

Question 5: Why is determining net worth important?

Determining net worth is essential for various purposes, including creditworthiness assessments, financial planning, legal matters, and understanding an individual's financial standing. It provides a snapshot of an individual's financial health, enabling informed decision-making regarding financial choices and strategies. This understanding informs potential investors, lenders, and individuals seeking to assess their financial trajectory.

In summary, determining net worth is a complex process. While various approaches are available, precise figures are often elusive, and relying solely on public information is inadequate. Acknowledging the limitations and employing professional valuation methods when necessary are vital for a thorough comprehension of the subject. These FAQs provide a starting point for understanding the nuances involved in financial valuations.

The subsequent section will delve deeper into specific valuation methods and their applicability in various contexts.

Conclusion

Determining the precise financial worth of an individual, such as "Al B Sure," proves a complex undertaking. The process requires a meticulous examination of assets, liabilities, income streams, expenses, and investment portfolios. While public information can offer some insights, comprehensive valuations necessitate detailed financial records and professional appraisal methodologies. The inherent variability in market conditions, economic trends, and the nature of assets themselves creates inherent limitations in achieving a definitive figure. Ultimately, any estimate of net worth must acknowledge these complexities and be viewed with appropriate context.

The exploration of "how much is Al B Sure worth" underscores the multifaceted nature of financial valuation. Understanding the nuances of asset assessment, liability evaluation, and investment analysis is critical for individuals seeking to understand their own or others' financial positions. Further research into specific valuation methodologies and the intricacies of different financial situations remains crucial for navigating the complexities of wealth assessment. A nuanced perspective and awareness of limitations are essential for responsible financial decision-making.

Article Recommendations

- Ted Danson Young A Journey Through The Early Years Of A Hollywood Icon

- Ed Hochuli The Legendary Nfl Referee And His Impact On Football

- Fred Weasley Actor The Magic Behind The Mischief