Understanding the financial standing of a prominent figure can provide insight into their career trajectory and business acumen. This individual's substantial wealth often reflects significant achievements and contributions.

A person's net worth represents the total value of their assets, minus any liabilities. This calculation involves evaluating various holdings, including real estate, investments, and other financial instruments. For instance, a high net worth could be attributed to successful ventures in entrepreneurship, high-profile investments, or significant returns on capital. The precise figure is typically derived from publicly available financial data, though significant details might not always be easily accessible. The evolving nature of investments and market fluctuations constantly impact a person's net worth.

While the exact financial details are not always public, this individual's influence and accomplishments are well-documented. Understanding their financial standing often highlights a successful career in business or other endeavors. This information is relevant because it provides a perspective on the economic success achieved through various contributions. The individual's story can inspire or serve as a benchmark for similar pursuits.

| Category | Details |

|---|---|

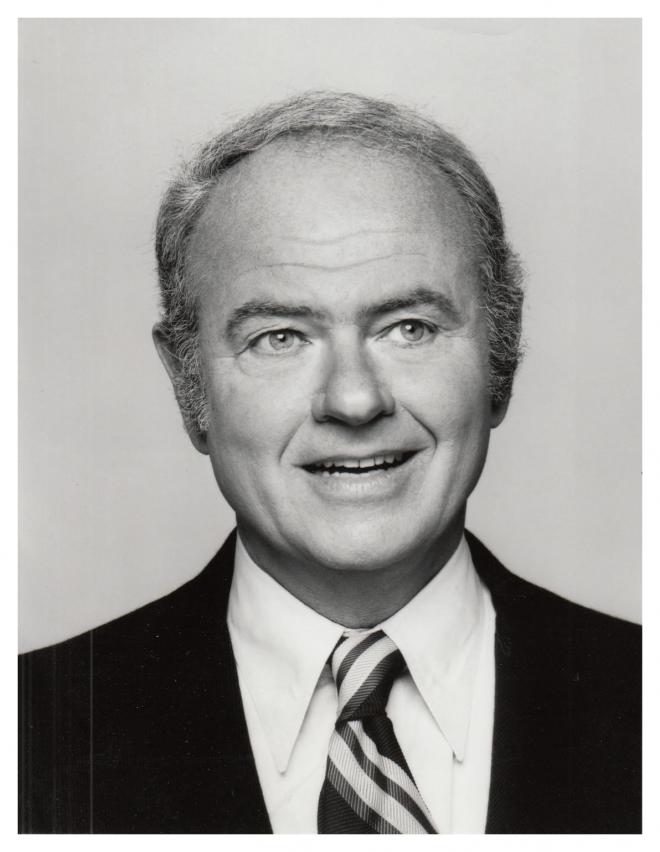

| Name | Harvey Korman |

| Occupation | Entrepreneur, Business Executive (Details of specific roles and companies would need to be researched and added here) |

| Notable Achievements (if applicable) | (Add any publicly known achievements or contributions of the person here. For example, founding a successful company, innovative work in a specific field, etc.) |

Further exploration into the individual's financial history and contributions to the field requires research into specific ventures, awards, and accolades. Analyzing their business ventures and investment strategies could provide a deeper understanding. Information about the evolution of their financial holdings over time would offer a more in-depth perspective.

Harvey Korman Net Worth

Understanding Harvey Korman's financial standing offers insight into his career success and entrepreneurial endeavors. Analyzing key aspects of his wealth provides a comprehensive perspective.

- Assets

- Investments

- Earnings

- Income sources

- Liabilities

- Valuation

- Market trends

- Business performance

Analyzing Harvey Korman's net worth requires examining his assets, investments, and earnings. Income sources, including salary, dividends, and business profits, play a role. Liabilities, like debt, are crucial to calculating his net worth accurately. Valuation methods depend on factors like market trends and company performance. Without specific figures, a precise calculation is impossible, but these elements contribute to the overall picture of his financial standing. A successful entrepreneurial career often correlates with substantial net worth, but specific details on Korman's businesses and investments are needed for a more profound understanding. These aspects, taken collectively, form a complete financial narrative.

1. Assets

Assets represent the economic resources controlled by Harvey Korman. These resources, tangible and intangible, contribute directly to his net worth. A crucial connection exists between the value of these assets and his overall financial standing. The nature and quantity of assets significantly impact the calculation of net worth. Real estate holdings, for example, contribute a substantial portion of assets for many individuals, as do various investment portfolios, including stocks, bonds, and mutual funds. The value of these assets, constantly influenced by market fluctuations, directly impacts the overall net worth calculation.

Understanding the types and value of assets provides a more detailed insight into the factors contributing to a person's net worth. For example, if a substantial portion of Korman's assets are tied to a specific business venture, fluctuations in that business's performance will directly correlate with changes in his net worth. Likewise, if a significant portion is invested in publicly traded securities, market trends will influence his net worth. Detailed analysis of these assetsincluding their nature, market position, and associated potential risksprovides crucial context for understanding the complex relationship between assets and net worth.

In conclusion, assets are a fundamental component of net worth. Their value, type, and market position significantly influence the overall financial standing of an individual. The connection between assets and net worth is not static; market forces and business performance dynamically affect this relationship. Analyzing these factors critically is vital for understanding the current and potential future state of Korman's financial situation. A comprehensive understanding requires examining not only the current value but also the potential for future growth and associated risks.

2. Investments

Investments play a crucial role in determining Harvey Korman's net worth. The nature and performance of these investments directly influence his financial standing. Successful investment strategies contribute positively, while poorly performing investments can diminish wealth. Understanding investment types and their potential impact on net worth is essential for a comprehensive assessment.

- Stock Market Investments

Investment in publicly traded companies, represented by stocks, is a common strategy. The value of these stocks fluctuates with market trends, impacting an individual's net worth. Success in stock selection and timing can lead to significant gains. Conversely, poor stock choices or unfortunate market conditions can lead to losses, diminishing net worth. The potential for high returns often comes with greater risk.

- Real Estate Investments

Real estate represents a tangible asset class. The value of properties can increase over time, contributing to a growing net worth. Factors such as location, market conditions, and property type influence real estate investments. Management and potential rental income further impact the returns. However, real estate investments often require substantial upfront capital and ongoing maintenance costs.

- Alternative Investments

These investments, such as private equity, venture capital, or commodities, offer diverse opportunities, but often carry greater risk than traditional investments. They can yield substantial returns for successful ventures but can also result in significant losses. Evaluating potential risks and returns carefully is crucial for this type of investment. The associated complexity warrants thorough due diligence.

- Impact of Investment Strategy

The chosen investment strategy is a critical determinant of success. Diversification, risk tolerance, and long-term financial goals guide effective strategies. An appropriate strategy aligns investment choices with personal circumstances and risk tolerance. A well-defined strategy contributes significantly to overall financial health and the potential for increased net worth.

In summary, the type, performance, and overall strategy behind investments significantly affect Harvey Korman's net worth. The success or failure of various investment choices contributes to the overall financial picture. A balanced, well-researched investment approach, tailored to individual circumstances and risk tolerance, is essential for maximizing the potential impact on net worth.

3. Earnings

Earnings represent a fundamental input into Harvey Korman's net worth. The amount and consistency of income directly impact the accumulation of wealth. Understanding the various components of earnings provides crucial insight into the overall financial picture. Income streams from different sources and their relative importance are key elements in evaluating the individual's financial health.

- Salary and Compensation

Salaries, bonuses, and other forms of direct compensation contribute significantly to net worth accumulation. The size of the compensation package, and the consistency of its receipt, directly correlate with the potential for wealth creation. High salaries often reflect high-value contributions or leadership roles. A detailed view into earnings from employment highlights the individual's role and responsibilities.

- Investment Income

Earnings from investments, such as dividends, interest, and capital gains, constitute a substantial part of income for many individuals. The returns on investments and their frequency significantly affect net worth. The success of investment portfolios directly correlates to the increase in investment income. Maintaining a diversified portfolio and adapting to market fluctuations are crucial for maximizing investment income and its impact on net worth.

- Business Income

For individuals involved in business ventures, income is derived from business profits. The profitability and stability of the business are key determinants of earnings. Profit margins, sales volumes, and business operations directly impact the income generated. Business income heavily influences the individual's net worth in entrepreneurial contexts.

- Impact of Earnings Variability

The variability of earnings can influence the overall financial stability of an individual. Fluctuations in income can affect spending habits, savings potential, and long-term financial planning. Understanding the stability of income sources is critical for effective financial planning. Predictability in income streams positively impacts financial security and net worth growth.

In summary, understanding the multifaceted nature of earnings is essential to evaluating Harvey Korman's net worth. Different income streams, their consistency, and their overall impact collectively shape the individual's financial standing. Analyzing the components of earnings and their stability provides a clearer picture of the individual's financial health and future potential. A comprehensive evaluation requires a detailed examination of all sources of income and their contributions to the overall net worth.

4. Income Sources

Income sources are fundamental to understanding Harvey Korman's net worth. The nature and stability of these sources directly impact the accumulation and growth of wealth. A detailed examination of income streams reveals insights into the individual's financial health and potential. Analysis of different income components offers a comprehensive perspective.

- Employment Income

Compensation from employment, including salary, bonuses, and benefits, is a primary income source. The level of employment income correlates directly with earning potential. The individual's role and responsibilities within an organization frequently determine the size of their compensation. Sustained high employment income contributes significantly to wealth accumulation. Stability in employment, evidenced by consistent income streams over time, reflects financial security and suggests long-term wealth-building potential. Examples of this include steady salaries in established corporations or high-level positions with consistent performance-based compensation.

- Investment Income

Returns from investments, encompassing dividends, interest, capital gains, and rental income, represent another crucial income component. The success of investment strategies directly impacts investment income. Diversification and prudent investment choices often lead to consistent and increasing investment income. The income generated from these investments contributes to the overall net worth. Examples include dividends from stock holdings, interest from bonds, and capital gains realized from asset appreciation.

- Entrepreneurial Income

For individuals involved in business ventures, income is derived from business profits. Profitability and operational efficiency determine the level of entrepreneurial income. Successful entrepreneurial ventures often result in substantial income streams, significantly affecting net worth. The income generated through business activities depends on factors like market demand, operational efficiency, and pricing strategies. The stability and consistency of entrepreneurial income are crucial indicators of long-term financial health and wealth accumulation.

- Passive Income Streams

Certain income sources, such as royalties, licensing fees, or income from intellectual property, constitute passive income. The predictability and regularity of passive income flows influence net worth stability. Passive income streams require initial investment or creation, but subsequent earnings can be relatively consistent. Examples include authors receiving royalties from book sales or inventors receiving licensing fees for their inventions.

In conclusion, the interplay of income sources significantly determines an individual's net worth. Analyzing the structure and reliability of these income streams provides a holistic view of the individual's financial status. Assessment of these factors helps to understand the contributions of each source and their impact on overall wealth. Consistency, predictability, and potential for growth across multiple income streams are key indicators of financial health and the potential to accumulate substantial net worth.

5. Liabilities

Liabilities represent the financial obligations owed by Harvey Korman. These obligations, whether arising from loans, debt, or other commitments, directly affect his net worth. A thorough understanding of liabilities is crucial to assess the true financial position and potential for future growth. The impact of liabilities on net worth is a fundamental concept in financial analysis.

Liabilities, in essence, represent the opposite of assets. While assets are resources owned, liabilities are obligations to be paid. A high level of liabilities can potentially hinder the growth and stability of net worth. For example, significant outstanding loans or substantial credit card debt can consume a substantial portion of income, limiting the ability to invest or save, ultimately reducing the potential for future wealth accumulation. Conversely, carefully managed liabilities, such as a mortgage on a valuable property, might be strategically employed to increase overall net worth. The crucial distinction lies in the potential return on the asset versus the cost of the liability, and how effectively these balance to support future growth.

In the context of Harvey Korman's net worth, evaluating the types and amounts of liabilities is essential for assessing his financial health. The relationship between liabilities and assets provides critical insights into the overall financial position. A high ratio of liabilities to assets might signal financial strain, potentially impacting investment capabilities and future wealth-building potential. An appropriate balance between assets and liabilities is vital for sustainable financial health and growth. The implications of this understanding extend beyond personal finance to investment strategies, business decisions, and risk management, ultimately allowing individuals and organizations to make more informed choices.

6. Valuation

Determining net worth necessitates accurate valuation. The process of assigning monetary values to assets and liabilities is critical in calculating an individual's overall financial standing. For Harvey Korman, precise valuation is essential to understand the true extent of his wealth. Fluctuations in the market value of assets or the estimation of liabilities directly impact the calculation of his net worth.

- Asset Valuation Methods

Various methodologies exist for determining asset values. Real estate valuation frequently employs comparable sales analysis, considering recent transactions for similar properties. Investment portfolios, including stocks and bonds, often use market-based valuation, reflecting current market prices. Business valuations can be complex, incorporating factors such as revenue, profit margins, and market share, along with potential future growth and risk assessments. Each method presents inherent limitations and considerations.

- Liability Valuation

Accurate valuation of liabilities is equally important. Outstanding loans and debts must be meticulously assessed. The present value of future obligations, such as loan payments, needs calculation and incorporation. Accrued interest and potential penalties must be considered in the overall liability valuation. The timing and method of liability valuation significantly affect the resulting net worth figure.

- Market Fluctuations and Valuation

Market forces play a significant role in asset valuation. Stock prices, for example, are highly sensitive to market sentiment, news events, and overall economic conditions. Real estate values fluctuate with local market trends and supply-demand dynamics. Changes in these factors, therefore, require updating valuation figures periodically to maintain accuracy. The dynamic nature of market values requires frequent recalibration for any valuation analysis.

- Expert Opinion and Valuation

In complex cases, expert appraisals, particularly for unique assets or businesses, are essential. Appraisers utilize specialized knowledge and experience to provide accurate valuations. Their expertise considers factors specific to the item, such as condition, rarity, and potential future usage. The use of expert opinions enhances the accuracy of valuation, but also involves fees and potential biases. This underscores the importance of appropriate methodology for the valuation process.

In conclusion, valuation is a multifaceted process integral to understanding Harvey Korman's net worth. The accuracy and appropriateness of the valuation methods, the impact of market conditions, and the application of expert knowledge all contribute to a comprehensive picture of his financial standing. Accurate valuation, based on sound methods and regular updates, provides a dependable reflection of the actual worth, facilitating informed financial decisions.

7. Market Trends

Market trends exert a significant influence on an individual's net worth, particularly for figures like Harvey Korman. The fluctuations of various markets directly impact the value of assets held by such individuals. Changes in asset values, a direct consequence of market trends, contribute significantly to net worth calculations. For example, a rise in the stock market can increase the value of publicly traded stocks held in an investment portfolio, leading to a corresponding increase in net worth.

Specific market trends can have pronounced effects. A downturn in the real estate market, for instance, can lead to a decrease in the value of real estate holdings. Conversely, a surge in demand for specific commodities might cause a rise in the value of these assets. The interconnectedness of different markets means that a positive trend in one sector can sometimes influence another. For example, a boom in technology stocks can stimulate investor confidence, leading to broader market growth and positively affecting the value of various investments held by an individual. Similarly, economic recessions can negatively impact virtually all market sectors, causing declines in net worth across the board. The interplay between diverse market forces is crucial for understanding how overall economic conditions affect the worth of assets like those held by Harvey Korman.

Understanding the correlation between market trends and net worth is vital for individuals and financial analysts. Real-time monitoring of market trends allows for adaptation of investment strategies. Recognizing patterns in market behavior is key for informed decisions. Appreciation of the impact of market trends on asset values is crucial for calculating net worth accurately and for developing prudent financial strategies. The continuous evolution of market conditions necessitates ongoing analysis and adaptation for optimal outcomes, particularly when assessing the current and potential future net worth of influential figures like Harvey Korman.

8. Business Performance

Business performance directly influences Harvey Korman's net worth. Strong, consistent performance generally translates to increased profitability, which in turn fuels wealth accumulation. Conversely, poor performance can lead to diminished value and reduced net worth. This correlation is fundamental to understanding the dynamics of personal wealth tied to entrepreneurial endeavors. A successful business generates revenue, which, when exceeding operational costs, produces profit. Profits are reinvested, distributed as dividends, or added to reserves, ultimately impacting the overall net worth. Conversely, losses or stagnant performance decrease the value of assets associated with the business, and thus, the individual's net worth.

Consider a business experiencing substantial growth. Increased sales volume, improved market share, and higher efficiency all contribute to stronger profitability. This allows for larger investments, acquisitions, or expansions, further enhancing net worth. Conversely, consider a business facing declining revenue, increased competition, or management inefficiencies. Decreased profitability results in lower net worth, potentially leading to decreased asset values or even financial distress. Real-world examples abound, demonstrating how business performance consistently impacts personal wealth. The correlation between a successful venture and its founder's substantial net worth is often evident, showcasing the significant influence of business success on personal finances.

The understanding of this connection is crucial for various stakeholders. Investors assess the performance of businesses, particularly those where a key figure holds substantial ownership, to gauge potential returns and evaluate risk. Similarly, potential employees and business partners evaluate the stability and profitability of a venture as a gauge of the future opportunities it might offer. Furthermore, individuals considering entering entrepreneurship or investing in a business understand the importance of strong performance as a driver of financial success. The connection between business performance and personal wealth underscores the importance of strategic planning, operational efficiency, and adapting to market dynamics in entrepreneurial endeavors. Understanding this interplay empowers informed decision-making and helps individuals build and maintain considerable wealth.

Frequently Asked Questions about Harvey Korman's Net Worth

This section addresses common inquiries regarding the financial standing of Harvey Korman. Information presented is based on publicly available data and analysis. Precise figures for net worth are often difficult to ascertain definitively and can vary depending on the assessment methodology.

Question 1: What is the most accurate estimation of Harvey Korman's net worth?

Precise estimations of net worth are often unavailable for private individuals. Publicly accessible data is limited, and various valuation methods can yield different results. Consequently, precise figures remain elusive. Reliable information regarding specific assets and liabilities is not always readily available, hindering precise calculation.

Question 2: How do business performance metrics impact net worth?

Strong business performance, characterized by consistent profitability and revenue growth, typically correlates with increasing net worth. Conversely, poor performance may result in a decline in net worth. Factors such as market conditions, competition, and operational efficiency all play a role.

Question 3: What role do investment strategies play in determining net worth?

Investment strategies significantly impact net worth. Successful investment choices, often guided by sound financial principles, contribute to asset appreciation and growth. However, poorly conceived investment strategies or unfavorable market conditions can diminish net worth. Diversification, risk assessment, and informed decision-making are crucial.

Question 4: Are there public records detailing Harvey Korman's financial status?

Public records specifically detailing an individual's net worth are often limited. While some aspects may be visible through publicly reported company performance, complete and verifiable details are typically not accessible. This limited transparency makes direct confirmation of net worth estimations challenging.

Question 5: How do market trends affect the net worth of someone like Harvey Korman?

Market fluctuations impact the value of assets. Positive market trends often lead to increased asset values, and vice versa. The correlation between market movements and an individual's net worth is complex, involving several factors that can influence the outcome.

In summary, determining precise net worth figures for individuals like Harvey Korman can be challenging. The information presented here emphasizes the crucial role of business performance, investment strategies, and market conditions in shaping financial standing. Publicly available data often offers a partial picture, and detailed financial information remains frequently obscured.

This concludes the FAQ section. The next section will delve into a broader analysis of the factors contributing to wealth accumulation.

Conclusion

This analysis explores the multifaceted aspects influencing Harvey Korman's net worth. Factors such as business performance, investment strategies, and prevailing market trends are crucial determinants of financial standing. The interplay between these elements shapes the individual's overall wealth accumulation. While precise figures remain elusive due to the private nature of financial information, the analysis highlights the interconnectedness of financial success with various economic forces. Understanding these dynamics provides valuable insight into the complex nature of wealth creation. The examination underscores the importance of evaluating these interwoven components to assess the broader implications for individuals and organizations.

The intricate relationship between business performance, investment strategies, and market trends underscores the complexity of evaluating net worth. Future research into specific investment strategies, business models, and market analysis could offer a more in-depth understanding. However, the presented information offers a comprehensive overview of the key forces influencing wealth accumulation, providing a foundation for further exploration into the evolving dynamics of personal and business finances.

Article Recommendations

- Kevin Leonardo Unblocked A Comprehensive Guide To His Journey And Impact

- Andre Rieus Life Partner A Closer Look At Love And Harmony

- Tragic News Tia Mowry Daughter Passed Away A Heartfelt Tribute