Who is the spouse of a prominent financial commentator? A prominent figure in financial media has a significant personal life, and understanding their relationship can offer valuable context.

The phrase "a prominent financial commentator and their spouse" signifies a couple where one partner holds a notable position within financial media. Examples might include discussions of personal financial decisions by a well-known financial commentator, which might have implications for personal investment strategies. The topic may also involve their combined personal wealth, philanthropy, or other forms of joint ventures.

Understanding the relationship between a financial commentator and their spouse can provide a multifaceted perspective. This might include analyzing their individual professional and personal influences on one another. It could also present insights into household financial management or broader societal trends related to wealth management, particularly if the spouse has significant financial roles or involvement. Historical context might reveal evolving roles of spouses in business ventures and financial circles.

Further exploration of this subject could delve into the commentator's financial advice, investment strategies, or personal philosophies, potentially highlighting the potential influence of their spouse in shaping those views. It could also provide a glimpse into the dynamics of relationships and power structures within the financial industry and wider society.

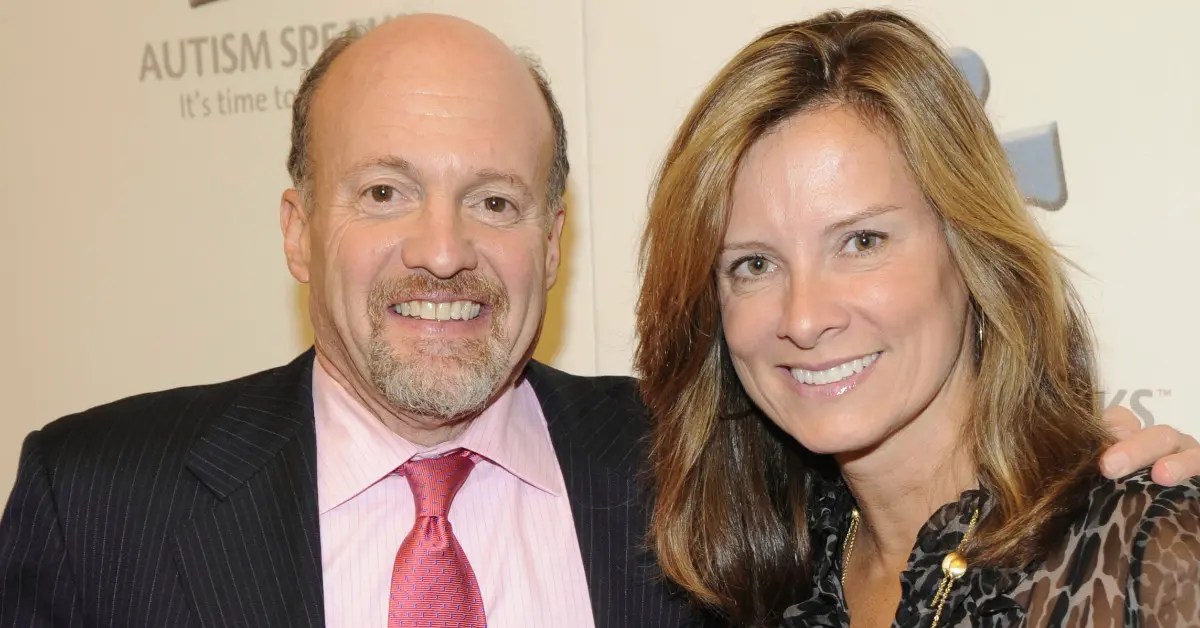

Jim Cramer and Wife

Understanding the relationship of a prominent financial commentator and their spouse offers insight into personal and professional spheres. The couple's dynamic, financial decisions, and public persona can reveal connections between personal and professional lives.

- Relationship Dynamics

- Financial Influence

- Public Persona

- Investment Strategies

- Media Presence

- Personal Wealth

- Philanthropy

- Public Perception

The interplay between Jim Cramer's public persona as a financial commentator and his private life with his spouse creates a complex dynamic. Financial influence extends beyond professional realms, potentially shaping personal investment strategies and overall financial decisions. A significant media presence, such as Jim Cramer's, necessitates a public perception that encompasses both professional and personal aspects. The couple's potential philanthropic involvement further illustrates the connection between personal wealth and broader societal impact. Examining each of these aspects reveals a multifaceted relationship between the individual and their spouse in the public eye.

1. Relationship Dynamics

The dynamics of a relationship between a prominent financial commentator, such as Jim Cramer, and their spouse are complex and multifaceted. These dynamics encompass a range of interactions, including communication patterns, conflict resolution strategies, and the division of labor within the household. A notable commentator's relationship can influence public perception, potentially affecting market confidence or investor behavior indirectly. Discrepancies in public image and private life could serve as significant factors, impacting the commentator's credibility and overall professional standing.

The couple's shared experiences and their management of personal finances can reveal insights into their decision-making process. Public statements about personal wealth or investment strategies could be affected by their relationship dynamics. Conversely, publicly perceived stresses or conflicts in the relationship might be reflected in the commentator's demeanor or approach to financial commentary. In addition, understanding the influence of significant others can offer a broader perspective on the financial commentator's overall mindset and approach to financial matters. For instance, a supportive spouse might foster a greater sense of confidence in the commentator's public persona, while differing perspectives could create internal tensions which potentially emerge in public commentary. The specific nature of these influences, positive or negative, would be contingent on individual situations.

In conclusion, the relationship dynamics between a high-profile commentator and their spouse are relevant because they provide insights into personal values, decision-making processes, and potential influences on professional actions. Analysis of these dynamics requires careful consideration of both publicly available information and the potential for private considerations. The complex interplay between personal and professional lives can significantly shape a financial commentator's impact on the financial markets and the public's perception of them.

2. Financial Influence

The financial influence exerted by a prominent figure, such as a financial commentator, and their spouse is a complex phenomenon. This influence isn't necessarily direct, but rather a combination of factors like shared financial decisions, investment strategies, and the public perception of their combined wealth. Financial success or challenges within a prominent relationship can impact individual perceptions and influence public sentiment surrounding the commentator's financial advice. For example, publicized decisions about joint investments or philanthropic endeavors by the commentator and their spouse can implicitly or explicitly suggest confidence in specific market sectors or investment approaches. Conversely, financial difficulties or discord within the relationship might lead to a reduction in credibility or public confidence in the commentator's expertise.

The importance of understanding this influence lies in the potential for correlation between a commentator's relationship and their financial commentary. Analysis of the couple's financial decisions and interactions can potentially provide context for evaluating the commentator's advice. Observed patterns in their personal wealth management strategies, or any shifts in their approach, could offer clues about their current market outlook. However, such inferences must be approached cautiously, recognizing that correlations don't equate to causation. The influence of a commentator's relationship on financial markets is not direct and should not be interpreted as a guarantee of market success or failure. Other external factors, such as broader economic trends or market sentiment, always play a significant role.

In conclusion, the financial influence exerted by a couple, including a high-profile commentator and their spouse, is a nuanced concept. Understanding the complexities of this influence, while recognizing its indirect nature and potential limitations, allows for a more comprehensive evaluation of the commentator's financial guidance. It is crucial to acknowledge that correlation does not equal causation when examining the potential link between a couple's personal financial decisions and market performance. Therefore, interpreting financial commentary should always be coupled with an awareness of broader economic factors.

3. Public Persona

A public persona, especially for a prominent figure like a financial commentator, is intricately linked to their personal life. The perception of a commentator and their spouse is crucial, often influencing public trust and credibility. Understanding the impact of this public perception is vital, particularly in the context of individuals like Jim Cramer and their partners, considering how their collective image shapes public understanding and potentially affects market dynamics.

- Impact on Credibility

The public image of a financial commentator and their spouse directly affects credibility. Public perception of the couple's stability, wealth management practices, and shared values can reflect upon the commentator's professional judgment. Positive perceptions often strengthen confidence in the commentator's advice, while negative perceptions can erode trust. Consistency between public image and private actions, or perceived inconsistencies, are critical factors in shaping perceptions of competence and honesty. Examples include public praise for the financial acumen of a commentator's spouse, influencing the perception of the commentator's expertise.

- Influence on Investor Behavior

The public persona, particularly when presented as a cohesive couple, can indirectly influence investor decisions. If the commentator and spouse exhibit financial sophistication or stability in public appearances, it may instill confidence in market analysis and investment recommendations. Conversely, publicized financial difficulties or marital discord can trigger a negative response and potentially cause investors to question the commentator's guidance.

- Role of Media Representation

Media portrayal significantly shapes the public persona of the commentator and their spouse. Selective presentation by media outlets and choices in how a couple is depicted in the public sphere can create lasting impressions. This media representation influences perceptions regarding the couple's values, lifestyle, and financial stability, in turn affecting the commentator's credibility as a financial advisor.

- Potential for Misinterpretation

Public perception can be susceptible to misinterpretation. A commentator's actions or public statements, even if unrelated to their financial insights, can be linked to their public persona, potentially affecting trust. For instance, personal decisions or statements made by the spouse, if perceived negatively, can inadvertently reflect upon the commentator's character and financial judgment, regardless of their actual personal relationship or independence of decision.

Understanding the intricate connection between public persona and personal life is crucial for analyzing the impact of figures like Jim Cramer and their spouses on the financial markets and public trust. Analyzing these facets provides insights into how personal relationships and public image intersect with and often influence a commentator's credibility, and their effectiveness in conveying financial information to the general public.

4. Investment Strategies

The connection between investment strategies and a prominent figure like Jim Cramer and their spouse is complex and multifaceted. Direct, explicit influence is unlikely, but the couple's financial choices, public pronouncements, and perceived financial stability can indirectly affect perceptions of Cramer's investment advice. Public displays of a shared financial strategy or wealth management practices might inadvertently influence perceptions of Cramer's recommendations, potentially bolstering or undermining public confidence in his strategies.

While no definitive causal link exists between the personal finances of Jim Cramer and his spouse and the success or failure of his investment recommendations, public perception plays a crucial role. A perceived shared investment success or financial stability might positively reinforce the credibility of his advice. Conversely, any public financial challenges or conflicts might diminish public confidence in the validity of his strategies. This is because investors often seek reassurance and build their confidence from available information, including observed financial situations of prominent figures. For example, if the public observes a pattern of successful joint investment decisions between Cramer and their spouse, this might lead to investors adopting similar strategies, leading to higher demand and potential price appreciation in those markets. However, a perception of financial strain or poor decision-making within the couple could lead to opposite outcomes. Real-world examples of prominent individuals whose public financial decisions influenced market perception illustrate this complex interplay.

Understanding the potential link between investment strategies and the personal financial lives of figures like Jim Cramer is essential to nuanced analysis. It prompts consideration of the various factors influencing investor behavior beyond purely market-based data. Crucially, it reinforces that while investment strategies should be evaluated independently, the public perception of a figure like Cramer and their spouse's financial choices is a factor that influences market sentiment and could potentially affect investor confidence. It highlights the indirect but significant impact of personal elements on the financial sphere, a dimension frequently overlooked in purely economic analyses.

5. Media Presence

The media presence of Jim Cramer and their spouse is a significant factor influencing public perception and potentially impacting market dynamics. This presence encompasses various media platforms, including television appearances, social media interactions, and print publications. The prominence of such a couple in financial media significantly shapes public understanding of Jim Cramer's commentary and the perception of the couple's financial well-being. The consistent portrayal in media outlets reinforces either confidence in Cramer's perspective or raises questions about his expertise.

Media coverage shapes public understanding of the couple, often highlighting their lifestyle and apparent financial stability or struggles. This portrayal can inadvertently impact investor behavior. A positive media image might inspire confidence in Cramer's investment recommendations, whereas negative portrayals could diminish investor trust. For instance, repeated positive media coverage associating Cramer with a particular investment approach might lead investors to adopt similar strategies, potentially influencing market trends. Conversely, news about a couple's financial difficulties or disagreements might raise questions about the reliability of investment advice presented by the commentator, inducing caution among investors. The influence of media portrayal on perceived financial stability cannot be underestimated.

Analyzing the interplay between media presence and the financial commentator and their spouse reveals a crucial link between personal and professional lives. Understanding how media shapes public perceptions and indirectly affects market sentiment is essential to fully evaluating Cramer's influence. The media serves as a potent tool for building or eroding trust in a financial commentator and their strategies, which further extends to shaping investors' overall market behavior. This complex relationship highlights the importance of separating personal narratives from market analysis when evaluating the commentator's recommendations. Ultimately, media presence is a vital component of assessing the impact of figures like Jim Cramer on the broader financial landscape.

6. Personal Wealth

The personal wealth of Jim Cramer and their spouse is a significant aspect, though often indirect, in evaluating the figure's influence and public perception. Public awareness of the couple's financial standing can shape investor trust in Cramer's financial commentary. A perception of substantial wealth can inadvertently strengthen the credibility of his investment strategies, while financial difficulties or perceived discrepancies could erode trust. The influence, however, is not direct; rather, the perception of wealth acts as a supporting element in the commentator's overall public image, which, in turn, can impact market sentiment.

Public knowledge of a financial commentator's wealth often carries significant weight. Investors might correlate a high net worth with sound judgment, leading to a heightened sense of confidence in the commentator's advice. This perception can be a powerful indirect influence on market behavior. However, if the perception shifts toward financial difficulties or inconsistencies, it could lead to decreased trust and a potential reassessment of the commentator's expertise. The interplay between personal wealth and public perception underscores the delicate balance between a commentator's personal life and their professional credibility within the financial markets. The impact can be nuanced and complex. A perception of high wealth might not always translate into actual market success. Conversely, a perceived lack of wealth might not necessarily diminish the validity of the commentator's strategies or financial acumen.

Ultimately, the relationship between personal wealth and a financial commentator's public image is a significant but complex one. The perception of wealth is just one component within a broader analysis of a figure's credibility. While awareness of financial standing can influence public opinion, it does not dictate the accuracy or effectiveness of investment strategies. Critically evaluating financial information should always encompass a broader range of factors beyond just personal wealth, recognizing the potential for bias and misinterpretation. Therefore, analysts should be cautious about overemphasizing personal wealth as the primary determinant of credibility or market influence.

7. Philanthropy

The philanthropic activities of individuals, including prominent figures like Jim Cramer and their spouse, often reflect values and priorities beyond purely financial pursuits. Analyzing such activities provides insights into the couple's broader motivations and potentially influences the perception of their overall image, both personally and professionally. The connection between philanthropy and a financial commentator like Jim Cramer can illuminate how societal contributions align with or contrast with financial guidance.

- Impact on Public Image

Philanthropic endeavors can significantly impact public perception. Contributions to charitable causes, whether large or small, often suggest a commitment to community well-being and ethical values, potentially enhancing the public image of the individuals involved. This positive perception, in turn, might indirectly influence how their financial commentary is received. For example, a consistent pattern of charitable contributions might bolster public trust in the commentator's integrity and financial judgment.

- Alignment with Values and Priorities

Philanthropy offers a glimpse into the values and priorities held by the commentator and their spouse. The selection of specific charities or causes for support can reveal their personal interests and commitments. This alignment can influence how the public perceives the commentator's overall character and judgment, potentially creating a link between philanthropic values and the commentator's financial counsel. For instance, support for education-related charities might imply a belief in the importance of human capital and investment in future generations. Such considerations are increasingly important in evaluating the values of public figures.

- Potential for Influence and Awareness

Public engagement in philanthropic endeavors can increase awareness of specific causes. The actions of a prominent figure like Jim Cramer can attract attention and resources to particular issues. Such visibility can encourage others to become involved in similar initiatives, demonstrating a potential ripple effect. A prominent couple's philanthropy can catalyze wider community engagement.

- Potential for Conflict or Misinterpretation

Philanthropic activities, even when well-intentioned, can be susceptible to misinterpretation. The choice of specific charities, or the timing and manner of donations, could be subject to public scrutiny and create unforeseen consequences for the public image of the commentator and their spouse. A perceived lack of transparency in philanthropic activities might reduce public trust or generate controversy, thereby impacting public perception of financial guidance.

In conclusion, exploring the philanthropic activities of figures like Jim Cramer and their spouses provides a crucial dimension in understanding their overall influence. This involves considering how their choices shape public perception, aligning values, and potentially catalyzing broader community participation while acknowledging the potential for misinterpretations or conflicts. These insights provide a more nuanced view of the interconnectedness between personal values, public image, and professional influence within the financial landscape.

8. Public Perception

Public perception of Jim Cramer and their spouse is a critical component of their public image and professional influence. This perception is shaped by various factors, including media portrayals, financial successes or setbacks, and perceived alignment of values. A positive public image can enhance credibility and trust in Cramer's financial commentary, potentially influencing investor behavior. Conversely, negative perceptions can erode trust and diminish the impact of his recommendations.

The interplay between personal and professional lives is particularly significant. Public perception of the couple's financial stability, lifestyle choices, and shared values can either reinforce or challenge the credibility of Cramer's investment advice. Positive associations with charitable giving or successful investments might bolster his image, while perceived financial difficulties or public disagreements could raise questions about his judgment and recommendations. For instance, if Cramer and their spouse are depicted as financially secure and successful, it might lead investors to perceive his commentary with more confidence. However, if there are consistent media reports of financial challenges, some investors might become hesitant to follow his suggestions. Real-life examples of commentators whose public images were affected by personal situations underscore the practical significance of understanding this interplay.

In summary, public perception of Jim Cramer and their spouse is a crucial element in assessing the figure's influence and credibility. The relationship between personal and professional spheres is vital, shaping the public's trust in his financial commentary. Understanding how different factors, such as media representation, financial decisions, and philanthropic activities, contribute to public opinion is essential for comprehending the impact of individuals like Jim Cramer on the financial landscape. Accurate analysis should recognize the nuanced role of public perception in this context.

Frequently Asked Questions about Jim Cramer and their Spouse

This section addresses common inquiries concerning Jim Cramer and their spouse, offering straightforward and informative responses to foster a clearer understanding.

Question 1: What is the professional relationship between Jim Cramer and their spouse?

The professional relationship between Jim Cramer and their spouse is not publicly defined, and specifics are not readily available. While Jim Cramer's professional activities are widely documented, the details of their spouse's career or involvement in financial matters remain largely confidential. Consequently, characterizing a direct professional link between the two is difficult, as the focus remains on Jim Cramer's financial commentary and not on joint ventures or collaborations.

Question 2: How does the public perception of Jim Cramer's personal life affect investor trust?

Public perception of Jim Cramer's personal life, including that of their spouse, can impact investor trust in his commentary. Positive portrayals can enhance credibility, suggesting sound judgment and financial acumen. Conversely, negative portrayals, or perceived inconsistencies between public image and private actions, can erode trust. Public perceptions related to personal wealth, lifestyle, and any marital or family issues are important factors, which indirectly shape public perception of the commentator's reliability and competency, thus potentially affecting investor decision-making.

Question 3: Does Jim Cramer's spouse have any financial involvement or public role?

Information regarding the spouse's direct financial involvement or public roles is often limited or not publicly accessible. Limited public information prevents a definitive assessment of their potential influence on market dynamics or Cramer's investment strategies.

Question 4: How do philanthropic activities of Jim Cramer and their spouse affect their image?

Philanthropic activities undertaken by the couple can shape public perception. Engaging in charitable endeavors can enhance a positive image, suggesting a commitment to societal well-being. However, a lack of transparency, misinterpretations, or potential conflicts surrounding these activities could potentially generate negative public reactions and influence perceptions of their financial commentary.

Question 5: What is the impact of media portrayals on the public perception of Jim Cramer and their spouse?

Media portrayals significantly shape public perception of the couple. Consistently positive coverage might foster trust, while negative or ambiguous depictions might lead to a reduction in perceived credibility. The nature and frequency of these portrayals, their selection criteria, and the potential for misinterpretation are all factors contributing to the ultimate public impression of the couple, and their indirect influence on financial markets.

In summary, the relationship between Jim Cramer and their spouse, while significant, is not always directly or explicitly tied to investment strategies or financial advice. Public perception of the couple plays a crucial role, and transparency in reporting public information would be beneficial for comprehensive analysis.

Next, we will explore the detailed impact of media coverage on financial markets.

Conclusion

This analysis explored the multifaceted relationship between Jim Cramer and their spouse, considering its implications within the financial context. The study highlighted the complex interplay between personal and professional spheres. Public perception of the couple, shaped by media portrayals, financial decisions, and philanthropic activities, plays a significant role in how Cramer's financial commentary is received and potentially impacts investor behavior. While a direct causal link between the couple's personal life and Cramer's investment advice is difficult to establish, the indirect influence is noteworthy. The analysis underscored the complex interplay between personal narratives and market sentiment, emphasizing that public perception is a crucial factor in evaluating the credibility and impact of financial commentators.

The study's findings suggest that a comprehensive understanding of financial commentary requires recognizing the potential influence of personal elements. Analyzing public perception, media representation, and the broader context of the couple's actions are crucial steps in evaluating the credibility of such commentary. Further research could explore specific instances where personal factors appeared to correlate with shifts in market sentiment, providing more detailed evidence of the subtle but potentially significant impact of personal narratives within the financial landscape. Ultimately, a discerning approach to financial information should acknowledge and contextualize personal elements alongside economic data for a more comprehensive and accurate assessment of market trends and investment strategies.

Article Recommendations

- Exploring The Life And Career Of Vernica Obanda

- Pierce Brosnan Children Family Legacy And Personal Insights

- Michael Consuelos A Rising Star In The Entertainment Industry