How do banks facilitate check processing and what role does a specific bank like Cadence play in this process? The streamlined system for processing checks at Cadence Bank is crucial for efficient transactions.

Check processing, a fundamental aspect of banking, involves a series of steps to verify and deposit checks. This typically includes verifying the check's authenticity, identifying the payer and payee, and confirming sufficient funds. Within this process, a bank like Cadence implements specific procedures for handling checks, which can range from traditional paper-based methods to modern electronic systems. The goal is to efficiently and securely process checks while ensuring timely payment to the recipient. Examples include processing personal and business checks, as well as processing checks through online and mobile banking channels.

The efficiency of a bank's check processing system is critical to both individual consumers and businesses. Fast and accurate check processing ensures timely payments, enabling businesses to manage their cash flow effectively and consumers to receive their funds promptly. Modern banking technologies have significantly impacted check processing, leading to faster and more secure transactions compared to older methods. Furthermore, strong security protocols in check processing minimize the risk of fraud and ensure the integrity of financial transactions. The ability to track checks through the process and receive accurate confirmation of payment status is a significant advantage for all parties involved. This efficiency is key to maintaining trust in financial institutions.

Moving forward, this article will delve into the specific processes employed by Cadence Bank for check handling and the technology behind them. The benefits of using Cadence's services, particularly from a consumer and business perspective, will be highlighted, illustrating how the bank's check processing contributes to a seamless and secure financial experience.

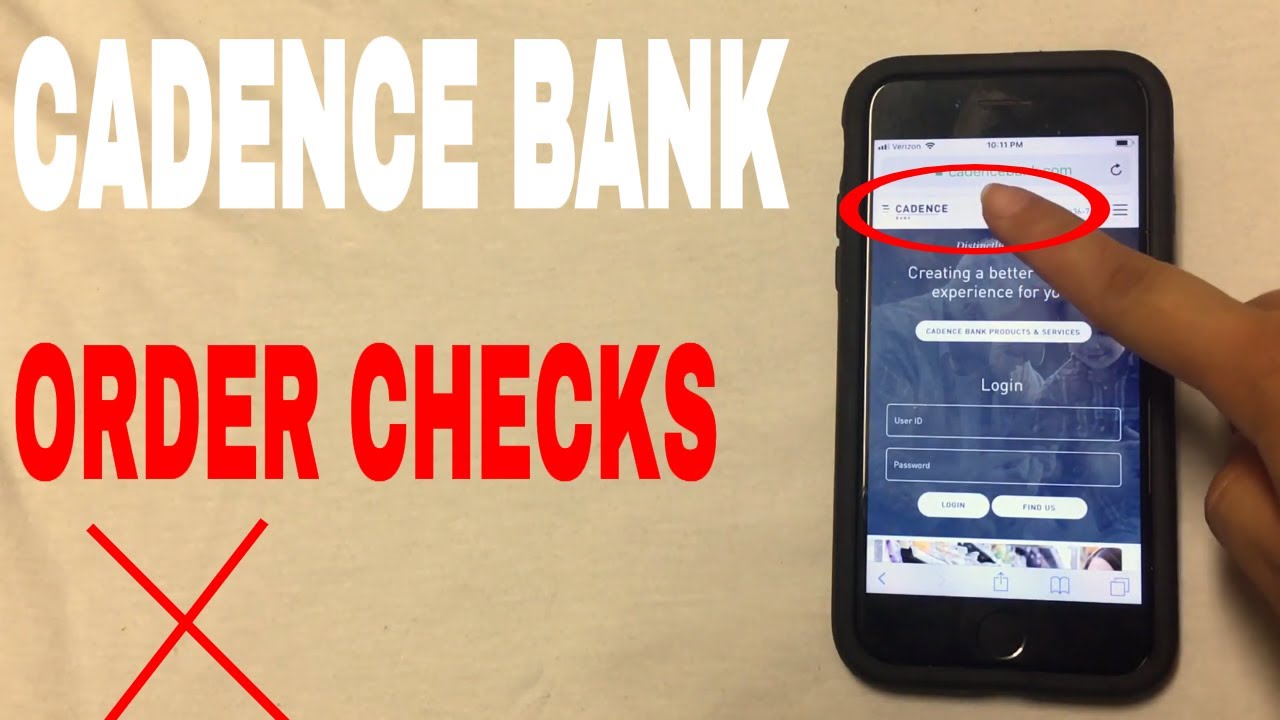

Cadence Bank Order Checks

Understanding the intricacies of Cadence Bank's order check procedures is crucial for a comprehensive overview of their banking services. Order checks represent a specific type of check transaction, and their handling reflects the bank's commitment to efficient and secure financial processes.

- Order check initiation

- Verification procedures

- Funds availability

- Security protocols

- Transaction tracking

- Clearing timelines

- Customer service

Cadence Bank's order check procedures encompass various stages, from the initial request to final payment. Verification procedures ensure the validity of the check and the availability of funds. Security protocols safeguard against fraud. Efficient tracking of the transaction is vital for timely resolution. Knowing the clearing timelines helps manage cash flow. Prompt customer service handles inquiries efficiently. Order check initiation involves various steps; examples include online platforms or physical form submission. These aspects highlight the complexity and importance of order checks within the larger context of banking transactions. Cadence Bank's adherence to established procedures supports the reliability and security of its financial services.

1. Order check initiation

Order check initiation is a fundamental component of Cadence Bank's order check processing. It marks the commencement of the transaction, encompassing the initial request and subsequent steps leading to check verification and payment. Initiation processes vary depending on the method of request online platforms, mobile banking apps, or traditional mail but all methods require accurate data entry and adherence to established procedures. A properly initiated order check ensures the system can accurately process and verify the transaction, avoiding delays and potential errors. Errors in this initial stage can cascade through the entire process, impacting timely payment and potentially causing issues for both the payer and the payee. For example, an incorrect account number or routing information entered during the initiation phase would necessitate correction, leading to significant delays.

The importance of accurate and prompt order check initiation cannot be overstated. A well-designed initiation process contributes to the bank's overall efficiency, minimizes errors, and safeguards against fraud. Robust validation mechanisms at this stage prevent mistaken transactions and reduce the likelihood of unauthorized payments. By implementing a standardized initiation procedure, Cadence Bank ensures a consistent and secure process for all customers, whether individuals or businesses, contributing to reliability and trust in its services. Real-world implications of a smoothly functioning initiation process include improved customer satisfaction through reduced processing times and increased accuracy in payment. This, in turn, enhances the bank's reputation and facilitates financial confidence for all parties involved. Additionally, efficient initiation procedures support a robust system for managing and reporting on check transactions.

In summary, order check initiation at Cadence Bank, as with any financial institution, is a critical step that lays the groundwork for smooth and accurate processing. Precise execution at this stage minimizes errors, strengthens security, and ensures timely payments. Understanding the intricacies of order check initiation is crucial for both customers and the bank, contributing to the overall efficiency and reliability of the financial transaction process.

2. Verification Procedures

Verification procedures are integral to Cadence Bank's order check process. They act as a crucial safeguard, ensuring the validity and legitimacy of each check presented for payment. These procedures, encompassing account verification, check authenticity, and funds availability confirmation, are essential for preventing fraud and ensuring that payments are processed accurately and reliably. Failure to implement robust verification procedures could lead to significant financial losses for both the bank and the customer. For example, a fraudulent check presented for payment without proper verification could result in unauthorized payment, and potentially expose the bank to liability. The accuracy and reliability of verification procedures directly impact the integrity and security of the entire transaction.

The importance of these procedures extends beyond preventing fraud. Verification procedures underpin the bank's ability to maintain a secure and efficient processing system. Accurate verification assures both parties of the transaction the customer ordering the check and the recipient that the check is valid and funds are available. This transparency and accountability in the verification process are crucial for building and maintaining customer trust. Examples include verifying account numbers against databases, confirming signatures on the check, and ensuring sufficient funds are available in the payer's account. Each step in the verification process contributes to the overall security and accuracy of Cadence Bank's order check system. A thorough verification process, for instance, may require cross-referencing account information with multiple internal databases and potentially interacting with other financial institutions to confirm the legitimacy of the transaction. Furthermore, these procedures enable proper handling of any discrepancies or potential issues that may arise during the check processing cycle. This thoroughness underscores the bank's commitment to responsible financial practices.

In conclusion, verification procedures are not simply a technicality but are the cornerstone of Cadence Bank's order check process. Their robust implementation ensures the accuracy, security, and reliability of the entire payment system. The procedures' importance in safeguarding against financial fraud and preserving customer trust cannot be overstated. By meticulously verifying each check presented, Cadence Bank strengthens its commitment to responsible and secure financial transactions, ultimately contributing to the overall stability of the financial system.

3. Funds Availability

Funds availability is a critical component in the processing of Cadence Bank order checks. Accurate assessment of available funds is paramount to prevent payment issues and maintain the integrity of the financial transaction. Incorrect or incomplete evaluation of funds can lead to delays or rejection of checks, negatively impacting the smooth operation of the banking system and potentially causing issues for both the payer and the payee. Understanding the complexities of funds availability is essential for comprehending Cadence Bank's procedures and the wider implications for check processing.

- Real-time Account Balances and Holds

Cadence Bank employs systems for real-time monitoring of account balances. This includes accounting for any holds or pending transactions that might impact the immediate availability of funds. A key aspect of this is the bank's ability to differentiate between funds immediately available for withdrawal and those that are reserved for specific purposes, such as pending debits or previous transactions. For example, a customer might have a significant balance but a large pending payment that affects the available funds for a check.

- Clearing Timeframes

The time it takes for funds to clear between accounts plays a critical role in funds availability. Checks often require a certain period for processing and clearing. The processing times for order checks vary based on factors like the payer's financial institution and the transaction's origin (e.g., debit, credit). Cadence Bank needs to accurately forecast these clearing times to ensure checks can be processed smoothly and funds are available to the payee by the agreed upon timelines.

- Security Protocols and Fraud Prevention

Funds availability assessment isn't just about verifying balances. It's integral to preventing fraud. Sophisticated systems identify unusual transactions and potential fraudulent activities. Implementing security protocols ensures sufficient funds are available before processing the check, minimizing the risk of unauthorized payment. For instance, if a system detects a potential fraud attempt involving a series of large transactions or unusual patterns, it might put a temporary hold on the check and halt the processing until further verification.

- Impact on Order Check Processing

Precise determination of funds availability is directly related to the smooth processing of order checks. A sufficient fund balance is a pre-requisite for payment. Without accurate and timely confirmation of funds availability, the bank cannot guarantee prompt payment, leading to potential delays in the transaction cycle. This aspect is crucial for maintaining customer satisfaction and confidence in the bank's services. In essence, the funds availability process is a cornerstone of maintaining order in the bank's overall check processing system and ensuring financial stability for all involved parties.

In conclusion, the funds availability process at Cadence Bank for order checks is integral to the efficiency and security of the banking system. Proper implementation of these aspects ensures timely payments, prevents fraudulent activities, and builds trust in the institution's operations. Effective procedures, including real-time monitoring, appropriate clearing timeframes, and robust security measures, are essential for guaranteeing order checks are processed accurately and reliably, minimizing risk for all parties concerned.

4. Security Protocols

Robust security protocols are essential for safeguarding Cadence Bank's order check process. These protocols mitigate risks associated with fraudulent activities, protect the bank's reputation, and maintain the integrity of financial transactions. Their implementation directly impacts the reliability and security of the entire order check system, ensuring trust and confidence in Cadence Bank's services.

- Authentication and Verification

Security protocols at Cadence Bank incorporate stringent authentication measures to verify the legitimacy of check orders. This involves scrutinizing the identity of the customer initiating the order, ensuring consistent adherence to established procedures. Examples include secure login systems, multi-factor authentication, and validation of account details against internal databases. Failure to implement rigorous authentication can expose the system to unauthorized access and potentially fraudulent activity. This verification layer is crucial for protecting the bank from fraudulent order checks and maintaining the reliability of the process.

- Data Encryption and Protection

Protecting sensitive data during transmission and storage is crucial. Encryption protocols safeguard account numbers, transaction details, and other confidential information. Modern encryption methods ensure that data remains incomprehensible to unauthorized individuals, even if intercepted. This protection is paramount in preventing data breaches and subsequent financial losses. Examples include using Secure Sockets Layer (SSL) or Transport Layer Security (TLS) for secure online transactions, and implementing strong encryption algorithms for data at rest.

- Fraud Detection and Prevention Systems

Sophisticated algorithms and advanced monitoring systems help identify unusual patterns and potential fraudulent activities. These systems analyze transaction data in real-time to flag suspicious activities, such as unusual transaction amounts or frequent requests from unfamiliar locations. These measures help prevent fraudulent orders and ensure that the payment system remains secure. Examples include anomaly detection systems, transaction monitoring tools, and collaborations with fraud prevention agencies. These systems act as a proactive safeguard against potentially fraudulent order checks.

- Compliance with Regulations

Adherence to industry regulations and legal requirements is a fundamental aspect of security protocols. This includes complying with anti-money laundering (AML) regulations and maintaining robust record-keeping practices. These regulatory standards help ensure compliance, minimizing potential legal liabilities and maintaining the institution's integrity. Examples include maintaining comprehensive transaction logs, adhering to Know Your Customer (KYC) standards, and reporting suspicious activity to relevant authorities.

In essence, security protocols for Cadence Bank order checks encompass a multifaceted approach. The interplay of authentication, encryption, fraud detection, and regulatory compliance creates a layered defense against potential threats. Robust security measures contribute significantly to the trust customers place in the bank's services, ensuring that order checks are processed accurately, efficiently, and securely. Effective security protocols are not only essential for preventing losses but also contribute to the bank's reputation and sustainable growth in the financial sector.

5. Transaction Tracking

Transaction tracking within the context of Cadence Bank's order checks is crucial for maintaining transparency, accountability, and efficient processing. It provides a detailed record of each step in the check's journey, from initiation to final settlement, allowing for swift resolution of any issues and maintaining a secure financial system.

- Verification of Check Status

Tracking provides a real-time view of a check's status. This allows both the sender and recipient to monitor the progress of the transaction, identifying any delays or discrepancies promptly. For example, knowing a check is currently undergoing verification at the payer's bank, or that it's awaiting confirmation of sufficient funds, helps manage expectations and anticipate potential issues. A clear status update streamlines the process, enabling corrective actions where needed.

- Accountability and Audit Trails

Detailed transaction records create an audit trail. This is essential for maintaining accountability and meeting regulatory requirements. The ability to trace each stage of a check's processing enables the bank to review and rectify any errors that may arise. For instance, if a check is returned for insufficient funds, the precise point of rejection can be identified and addressed, preventing similar issues in the future. This transparency builds trust within the financial system.

- Resolution of Disputes and Fraud Detection

The detailed records of a check's journey provide crucial data for resolving potential disputes. For example, if a customer claims a check was not processed, the comprehensive records of the check's progress can determine its current status and locate points of potential discrepancy. This transparency also assists in identifying potential fraudulent activities. Tracking can reveal unusual patterns or inconsistencies in a check's processing, enabling banks to detect and prevent fraud effectively.

- Improving Processing Efficiency

By tracking each step in an order check's processing, Cadence Bank can identify bottlenecks and inefficiencies in the system. For instance, unusually long processing times for a particular set of checks might indicate a need for process improvement or resource allocation adjustments. Data gathered from this tracking provides insights into potential areas where the bank can optimize operations and enhance processing speed, potentially leading to better service delivery and higher customer satisfaction.

Effective transaction tracking in Cadence Bank's order check system is more than a technical feature; it's a core component of building a dependable and secure financial ecosystem. It fosters trust between customers and the bank by enabling transparency, promotes timely resolution of potential issues, supports fraud prevention, and ultimately enhances the bank's operational efficiency. By maintaining a clear picture of the check's progress at every stage, Cadence Bank can efficiently manage its financial operations and maintain its position as a reliable banking institution.

6. Clearing Timelines

Clearing timelines are a critical element in the processing of Cadence Bank order checks. These timelines dictate the time required for funds to transfer between accounts following the issuance of a check. Accurately predicting and managing these timelines is vital for several reasons. A check's timely clearing enables both the payer and payee to confidently plan their finances. Delays can disrupt cash flow, leading to difficulties in managing budgets and operational requirements. Understanding the factors influencing clearing timelines is essential for mitigating potential financial disruptions and ensuring smooth transactions.

Several factors influence clearing timelines for Cadence Bank order checks. These include the geographic location of the payer and payee's banks, the type of check (e.g., personal, business, certified), the method of payment (e.g., electronic, physical check), and the volume of transactions processed during peak periods. Different financial institutions might employ varying processes, adding further complexity. A check originating in a regional bank and destined for a large metropolitan bank might experience a longer clearing time due to the distance between institutions and their respective processing operations. Real-world examples include a business relying on timely payments for invoice settlements or a personal consumer needing funds to be available on a specific date. Accurate anticipation and monitoring of clearing timelines play a crucial role in mitigating these potential issues.

Precise understanding of clearing timelines provides several practical benefits. Businesses can better plan their cash flow by factoring in the expected time it takes for checks to clear. Consumers can ensure funds are available on a desired date, enabling them to meet their financial obligations. Cadence Bank, in turn, is better equipped to manage its operations, ensuring prompt payment and maintaining its reputation for reliability. By proactively incorporating clearing timelines into their check processing strategies, all parties involved including the bank, the payer, and the payee can minimize potential financial disruptions and maintain confidence in the system. Moreover, accurate prediction allows for contingency planning and proactive measures to address possible delays. This careful attention to detail reflects a commitment to transparency and customer satisfaction.

7. Customer service

Customer service plays a critical role in the handling of Cadence Bank order checks. Effective customer service during the check processing lifecycle is paramount. Issues with checks, whether due to discrepancies, delays, or errors, necessitate prompt and efficient resolution. A robust customer service system enables swift communication and resolution, minimizing disruptions to the transaction for both the payer and the payee. For example, a timely response to an inquiry about a check's status or a clear explanation for a delay in processing builds trust and reinforces the bank's commitment to reliable services. Conversely, inadequate customer service can damage the bank's reputation and create frustration for clients. A delayed response or a lack of transparency regarding a check's status can lead to misunderstandings and mistrust.

The practical significance of effective customer service in this context is substantial. Clear communication channels, such as dedicated phone lines, online portals, or email addresses, facilitate easy access for customers to inquire about check processing. Prompt responses to inquiries, detailed explanations regarding issues, and efficient resolution mechanisms are vital components of effective customer service. Furthermore, timely updates on the status of a check order, whether it is awaiting verification, processing, or clearance, provide crucial transparency for both parties. An individual or business expecting a payment can anticipate the process and address potential concerns in advance. This, in turn, bolsters the bank's credibility and reinforces the stability of its financial processes. Real-life examples include cases where a timely phone call from a customer service representative clarified an issue with an order check, resulting in a swift and satisfactory resolution. This positive experience strengthened customer trust and loyalty toward the institution.

In summary, effective customer service is integral to the overall success of Cadence Bank's order check operations. A dedicated and responsive customer service approach is crucial for addressing issues, maintaining transparency, and building trust. The importance of promptly and efficiently resolving check-related inquiries directly translates to customer satisfaction and financial security. Consequently, the quality of customer service provided during the order check process reflects on the broader image and reliability of Cadence Bank, shaping client relationships and ensuring smooth, secure financial transactions. The importance of this connection underscores the value of a customer-centric approach in a financial institution like Cadence Bank.

Frequently Asked Questions

This section addresses common questions about Cadence Bank's order check procedures. Accurate information regarding these processes is crucial for a smooth and secure financial experience.

Question 1: What is an order check, and how does it differ from a standard check?

An order check is a check issued by a bank upon request. It is distinct from a standard check, which is drawn on an account held by the payer. The key difference lies in the initiation source. The order check is directly processed by the issuing bank, often in response to a specific customer need for immediate payment. This characteristic distinguishes order checks from the typical check-issuing process, ensuring a quicker and more streamlined transaction.

Question 2: How long does it typically take to process an order check?

Clearing times for order checks vary based on several factors, including the payer's financial institution, the type of check, and the volume of transactions being processed. Cadence Bank strives to process orders efficiently. However, precise timelines cannot be guaranteed and depend on the specifics of the individual order. Customers are encouraged to contact customer support for specific estimated processing times.

Question 3: What information do I need to initiate an order check request?

The exact details required to initiate an order check request are dependent on Cadence Bank's procedures. Customers should review Cadence Bank's official documentation or contact their customer service representatives for a comprehensive list of necessary information. This will include, but may not be limited to, details about the intended payee, the amount of the check, and pertinent account information.

Question 4: How do I track the status of my order check?

Cadence Bank offers various methods for tracking the status of order checks. These methods may include online portals, mobile applications, or dedicated customer service channels. The specific method for tracking is dependent on Cadence Bank's procedures and can be found within their online resources or clarified with customer service representatives. Comprehensive records enable customers to monitor the transaction's progress and address potential issues efficiently.

Question 5: What are the security measures Cadence Bank employs to protect order check transactions?

Cadence Bank employs a multi-layered approach to security. This includes stringent authentication procedures, encryption protocols, and advanced fraud detection systems. These measures are intended to safeguard both customers' accounts and the integrity of transactions. Cadence Bank's security measures are constantly updated to address emerging threats.

Understanding these frequently asked questions provides valuable insight into the order check process. For precise and updated details, customers should consistently refer to official Cadence Bank materials or directly consult their customer service team.

The following sections will delve into the more detailed aspects of Cadence Bank's services.

Conclusion

Cadence Bank's order check procedures represent a critical component of the institution's overall financial operations. The article's exploration highlighted the multifaceted nature of these processes, ranging from order check initiation and verification to funds availability, security protocols, transaction tracking, clearing timelines, and dedicated customer service. Key elements of these procedures include safeguarding against fraudulent activities, maintaining transparency, and ensuring timely processing of transactions. The efficient and secure handling of order checks is essential for maintaining the bank's reputation for reliability and fostering trust within the financial community.

The security and efficiency of order check processing directly impact the stability of the entire financial ecosystem. Cadence Bank's commitment to maintaining stringent security protocols, coupled with transparent transaction tracking and timely clearing, reflects a dedication to responsible financial practices. As the financial landscape evolves, continued attention to the nuances of order check processing remains crucial for maintaining the integrity of financial transactions and upholding the institution's reputation for reliability and security. Thorough examination and refinement of these procedures are essential for future success in the competitive banking sector.

Article Recommendations

- Linus Tech Tips Age Unveiling The Journey Of A Tech Icon

- The Intriguing Personal Life Of Brian Quinn And His Mysterious Wife

- Understanding Martin Lawrence Height The Iconic Comedians Physical Stature