What is the financial standing of this prominent figure? A closer look at their accumulated wealth reveals important insights into their career trajectory and success.

Determining the precise financial holdings of any individual, including those in the public eye, is inherently complex. Public records, financial disclosures, and estimated values often form the basis of such assessments. These valuations are frequently influenced by factors such as income sources (e.g., salary, investments, royalties), assets (e.g., real estate, art collections), and outstanding debts. Such estimations can vary among different sources, leading to a range of possible figures.

Understanding an individual's accumulated wealth, while not always straightforward, can provide a valuable perspective on their success in various ventures. Such an understanding can offer insight into economic trends, the profitability of specific industries, or the overall economic climate. This data can also foster a broader understanding of career paths, highlighting successful strategies and financial outcomes. However, it's crucial to recognize the limitations of estimated valuations and not equate them to definitive figures.

The following article will delve into the factors influencing the assessment of significant wealth, and explore the implications for individuals, businesses, and the broader economic landscape. This analysis will avoid focusing on specific financial figures for the sake of maintaining a wider, more objective view.

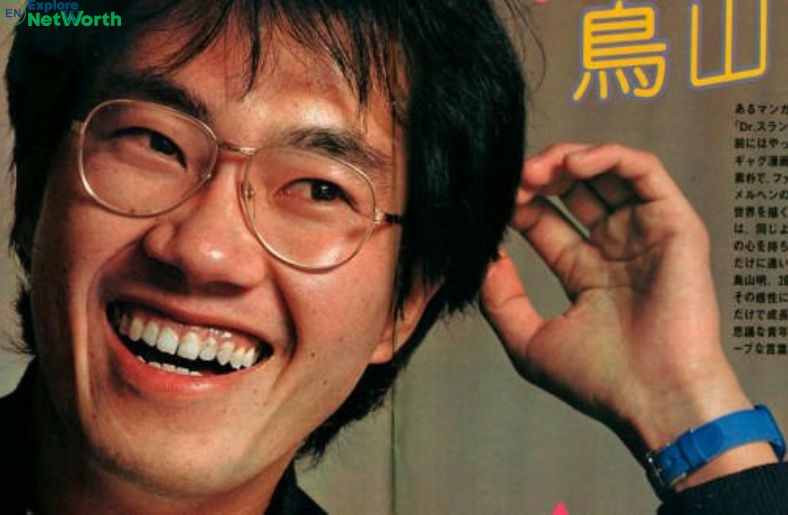

Toriyama Net Worth

Assessing an individual's financial standing involves a multifaceted approach, considering various factors that contribute to accumulated wealth. This analysis considers key aspects of the process.

- Income Sources

- Asset Valuation

- Investment Returns

- Business Revenue

- Debt Levels

- Market Fluctuations

- Industry Trends

- Public Perception

Analyzing Toriyama's (or any individual's) net worth requires a thorough understanding of income sources, encompassing salaries, investments, and potential royalties. Accurate asset valuation, considering real estate, art, and other holdings, is essential. The role of investment returns on various portfolios is crucial. For individuals in business, revenue streams and profit margins significantly affect the overall financial picture. Debts, both personal and business, must be accounted for. Market conditions influence asset values and investment returns. Industry trends can impact profitability. Finally, public perception, though not always quantifiable, can influence estimations of an individual's worth. For example, a public figure in a high-demand industry might command higher valuation than a similar figure in a less recognized field.

1. Income Sources

Income sources form a critical component in assessing an individual's overall financial standing. Understanding the nature and magnitude of these sources provides crucial insights into the factors contributing to accumulated wealth, including the potential for future growth. In the context of evaluating "Toriyama's net worth," analyzing income sources is essential.

- Salary/Compensation

A primary income source, salary or compensation directly reflects the value assigned to an individual's work and contributions to an organization. Variations in compensation reflect expertise, market value, and industry standards. High salaries often correlate with higher net worth potential, but factors beyond direct income, such as benefits and investment opportunities, also play a part.

- Investment Income

Income generated from investments, such as dividends, interest, or capital gains, can significantly bolster overall wealth accumulation over time. The type and performance of investments are pivotal factors. High-yield investments can contribute substantial income, while less profitable investments can have minimal impact. Consistent and substantial investment income signifies a potentially strong financial position.

- Royalties/Intellectual Property

For individuals involved in creative endeavors or possessing intellectual property, royalties or income from such assets can be a substantial source of revenue. The value and demand for intellectual property influence the amount of royalty income. Successful licensing or exploitation of intellectual property significantly impacts financial stability and can be a critical component of an individual's overall net worth.

- Business Revenue

If involved in business ownership, income derived from the enterprise is crucial. Profitability, market share, and industry performance directly impact this income stream. The stability and scalability of the business significantly affect long-term wealth accumulation and thus potential net worth.

In conclusion, analyzing the various income sources of an individual is fundamental in understanding their wealth trajectory. Examining salary, investment returns, royalties from intellectual property, and business income provides a comprehensive view of the factors influencing accumulated wealth and, consequently, an understanding of the multifaceted nature of "Toriyama's net worth."

2. Asset Valuation

Determining an individual's net worth necessitates careful assessment of assets. Asset valuation plays a critical role in this process, directly influencing the calculation and overall understanding of accumulated wealth. The accuracy and comprehensiveness of asset valuation directly impacts the perceived value or "Toriyama net worth," reflecting the total economic worth of the individual.

- Real Estate Valuation

Real estate holdings, including homes, land, and commercial properties, represent a significant component of many individuals' assets. Evaluating their market value involves considering factors like location, size, condition, comparable sales in the area, and current market trends. Fluctuations in real estate values can have a substantial impact on overall net worth, reflecting the inherent volatility of this asset class. Accurate valuation is crucial.

- Investment Portfolio Valuation

The value of investments, encompassing stocks, bonds, mutual funds, and other financial instruments, is another crucial aspect of asset valuation. Determining the current market value of these holdings requires assessing current market conditions, the performance of specific investments, and potential future prospects. Changes in market conditions can drastically alter the overall value of an investment portfolio and, thus, an individual's net worth.

- Personal Collectibles Valuation

Personal collections, including art, antiques, and collectibles, often carry significant, albeit variable, value. Determining the worth of such items can be complex and necessitate expert appraisal and market research. The value of these items is often subjective, depending on factors like rarity, condition, historical context, and current market interest. These factors complicate valuation and contribute to potential fluctuations in the assessed net worth.

- Tangible Asset Valuation

Valuing tangible assets, such as vehicles, equipment, and machinery, involves considering factors like age, condition, functionality, and market demand. Depreciation, wear and tear, and obsolescence influence the overall valuation. Accurate assessment of tangible assets is necessary for a complete understanding of net worth, considering their contribution to the overall financial picture.

In conclusion, careful asset valuation is a complex process requiring expertise and attention to detail. Factors like market trends, condition, and specific characteristics influence the overall calculation of an individual's net worth. A comprehensive and accurate evaluation of all asset classes is crucial for understanding "Toriyama's net worth."

3. Investment Returns

Investment returns are a critical component in assessing overall net worth, influencing the accumulation and growth of wealth over time. The performance of investment portfolios directly impacts the total value of assets held. Significant returns enhance the overall net worth, while poor returns can diminish it. The magnitude and consistency of these returns are critical factors in determining long-term financial standing. This relationship is evident in various real-world scenarios. Successful entrepreneurs who invest wisely and see positive returns often demonstrate substantial net worth. Conversely, individuals who invest poorly may experience a decline in their overall financial standing. This principle applies to a wide range of individuals and their financial strategies.

The importance of investment returns extends beyond simply accumulating capital. Investment returns can generate additional income streams, fostering financial independence and security. Smart investments in diversified portfolios can yield returns that offset the need for reliance on a single income source. Such returns can lead to financial freedom and provide a foundation for long-term financial stability. The ability to generate substantial investment returns contributes significantly to an individual's financial well-being. The strategic management of investments plays a significant role in increasing financial security and long-term stability. Examples range from individuals who successfully grow their retirement savings through savvy investments to large institutional investors who rely on consistent returns for growth. The broader economic impact is also evident, as successful investment strategies stimulate economic activity and contribute to overall prosperity. This underscores the importance of prudent investment decisions and the impact of successful investment returns on overall financial prosperity.

In conclusion, investment returns are inextricably linked to an individual's overall net worth. A sustained and high rate of investment return often translates to increased financial security and independence. Conversely, consistent poor returns can negatively impact an individual's financial position. The importance of prudent investment strategies and the significant contribution of positive investment returns are undeniable factors in determining and maintaining a substantial net worth. The practical implication of this connection underscores the need for informed decision-making and strategic investment management when aiming for substantial wealth accumulation.

4. Business Revenue

Business revenue is a crucial component in determining an individual's overall net worth. The profitability and success of ventures directly affect the accumulated wealth of the individual associated with them. Analyzing business revenue streams provides insights into the financial health and growth potential of an enterprise, which, in turn, reflects the financial standing of the owner or stakeholders. This analysis focuses on how business revenue impacts an individual's overall net worth.

- Profitability and Revenue Growth

Profitability, measured by the difference between revenue and expenses, is paramount. Consistent increases in revenue, driven by factors like market share expansion, new product launches, or strategic partnerships, indicate a healthy business. This upward trend directly contributes to a higher net worth, reflecting increasing wealth accumulation. A declining revenue stream often signals financial distress and potential reduction in overall net worth.

- Types of Revenue Streams

Understanding the variety of revenue sources is essential. Businesses can generate income from various operations, such as product sales, service offerings, or investments. A diversified revenue stream can make the business more resilient to market fluctuations. The complexity of the revenue structure adds to the multifaceted nature of the calculations in assessing net worth. Analysis must consider the contribution of each revenue stream to the overall financial health.

- Market Position and Industry Trends

A business's market position relative to competitors significantly impacts its revenue potential. Businesses dominating their niche, or those well-positioned for future growth within a sector undergoing expansion, often generate higher revenues and thus contribute substantially to an individual's net worth. Conversely, businesses facing economic challenges or industry downturns may see revenue declines, affecting the individual's overall financial position.

- Business Structure and Ownership

The structure of the business, whether sole proprietorship, partnership, or corporation, influences how revenue is distributed and taxed. Ownership structure affects how revenue translates to the individual's personal assets. Variations in taxation and financial reporting conventions further complicate the connection between business revenue and net worth, necessitating meticulous analysis.

In conclusion, business revenue is intricately linked to an individual's net worth. Analyzing revenue streams, profitability, market position, and business structure provides critical context in assessing the overall financial standing of the individual associated with the business. These factors must be carefully considered when evaluating the contribution of business revenue to "Toriyama net worth".

5. Debt Levels

Debt levels significantly impact an individual's net worth. High levels of debt can erode assets and reduce overall financial health. Conversely, low or manageable debt can contribute to a more secure financial position. Understanding the nature and extent of debt is therefore crucial in evaluating the true value of an individual's assets. This analysis highlights the relationship between debt and net worth.

- Types of Debt

Different types of debt have varying implications for net worth. Mortgages, loans, and credit card debt represent common forms. Short-term debt, like credit card balances, can quickly accumulate and negatively impact available funds. Long-term debt, such as mortgages, may require substantial ongoing payments, potentially impacting spending and investment decisions. Analyzing the types of debt provides a clearer picture of the potential strain on finances and its effect on net worth.

- Debt-to-Asset Ratio

The debt-to-asset ratio is a crucial metric. A high ratio indicates a significant portion of assets are financed through debt, potentially jeopardizing financial stability and impacting net worth. A low ratio often suggests a more secure financial position, as a smaller portion of assets are obligated to debt repayments. This ratio helps in understanding the leverage employed and its implications for future financial health. The ratio is often considered in relation to creditworthiness and risk assessment.

- Interest Rates and Payments

Interest rates directly affect the cost of borrowing. Higher interest rates lead to more significant debt repayments, reducing disposable income and hindering wealth accumulation. Conversely, lower interest rates make debt more manageable, freeing up funds for investment and growth, thereby positively influencing net worth. Regular payments and consistent repayments are critical for avoiding default and protecting financial standing.

- Debt Management Strategies

Effective debt management strategies are vital. Methods like debt consolidation or balance transfers aim to simplify debt repayment schedules and reduce interest costs. Strategic debt management frees up capital for investments, leading to enhanced wealth building. Conversely, poor debt management can negatively impact an individual's financial position, leading to reduced net worth and potential financial hardship.

In summary, assessing an individual's net worth requires a comprehensive evaluation of debt levels, including the types of debt, the debt-to-asset ratio, interest rates, and available debt management strategies. These factors all play a significant role in influencing the overall financial stability and future potential for wealth accumulation. The relationship between debt and net worth highlights the need for prudent financial planning and responsible borrowing practices.

6. Market Fluctuations

Market fluctuations represent a significant external force impacting an individual's net worth. Changes in market conditions, encompassing various economic factors, can dramatically affect asset values and, consequently, the overall financial position. Understanding this dynamic is crucial for evaluating and interpreting the impact on an individual's wealth. This analysis delves into specific aspects of market fluctuations and their connection to an individual's overall financial well-being. The fluctuating market landscape plays a vital role in shaping overall financial stability.

- Stock Market Volatility

Fluctuations in stock market indices directly affect the value of investments, particularly those in equity-based instruments. A downturn can significantly reduce the value of stock holdings, potentially impacting an individual's net worth. Conversely, positive market trends can increase the value of these holdings. The rapid changes in stock prices often challenge investors' ability to react and adjust strategies effectively, and their impact on net worth can be substantial and immediate. Examples include the 2008 financial crisis, the dot-com bubble, or the recent market corrections. These events illustrate the potential for significant gains or losses and their bearing on net worth calculations.

- Real Estate Market Cycles

Real estate values are susceptible to market cycles. Periods of growth can increase property values, enhancing net worth. Conversely, downturns can lead to depreciating real estate values, reducing the overall net worth. Factors such as interest rates, inflation, and economic conditions influence these cycles. Variations in real estate pricing, based on geographic location and property types, can lead to substantial differences in the impact on net worth.

- Currency Exchange Rates

Individuals holding assets denominated in foreign currencies face fluctuations influenced by currency exchange rates. Changes in exchange rates affect the value of international investments, potentially impacting net worth. For instance, a strengthening of a home country's currency against a foreign currency can result in a gain in value for foreign assets when converted back to the home currency. Conversely, currency fluctuations can result in losses for investors, impacting net worth in the aggregate. These unpredictable movements present both opportunities and risks.

- Interest Rate Shifts

Changes in interest rates influence borrowing costs and investment returns. Rising interest rates increase the cost of borrowing, potentially affecting the financial capacity of individuals and negatively impacting their net worth. Lowering interest rates can stimulate borrowing and investment, improving net worth and fostering economic activity. The impact of interest rate changes is substantial and influences both individuals and businesses, making it crucial to consider this in assessing net worth. These changes frequently accompany economic policies and influence investment decisions.

In conclusion, market fluctuations present both opportunities and threats to an individual's net worth. Understanding the potential impact of these forces is essential. By recognizing the influence of these fluctuations on different asset classes, individuals and investors can better prepare for varying market conditions. The interplay between these factors creates a dynamic environment, requiring adaptive strategies to protect and enhance an individual's financial well-being.

7. Industry Trends

Industry trends exert a significant influence on an individual's financial standing, particularly in cases where professional success is intertwined with industry performance. Understanding how industry trends evolve and adapt is essential for evaluating the potential trajectory of an individual's wealth. An evolving industry can create new opportunities or diminish existing ones, and these shifts directly affect an individual's financial success, impacting the overall valuation or perceived net worth.

- Innovation and Disruption

Technological advancements and emerging technologies often reshape industries. Companies that adapt quickly to these innovations are likely to thrive and increase profitability, potentially enhancing the financial standing of individuals associated with them. Conversely, firms resistant to change or failing to keep up with these developments often face challenges, impacting the wealth of stakeholders. Examples include the rise of e-commerce disrupting traditional retail, or the impact of AI on various sectors. The response to such changes can dictate the financial outcomes for individuals within these industries.

- Globalization and Competition

Globalization increases competition. The growth of international markets and the rise of new competitors can affect a company's market share and profitability. A company or individual succeeding in global markets will likely see increased revenue and enhanced financial standing. However, companies struggling to compete globally may see decreased revenues and diminished net worth. The changing global landscape is a substantial factor in assessing industry trends and their effect on individual wealth.

- Economic Conditions and Regulations

Economic cycles and government regulations influence an industry's performance. Periods of economic growth usually result in increased demand and profitability, boosting the financial well-being of industry participants. Conversely, recessions or stringent regulations can reduce demand and hinder profitability, potentially diminishing the value of individuals associated with the industry. Analysis should consider how a particular industry responds to macroeconomic conditions and governmental influences.

- Consumer Preferences and Demographics

Shifting consumer preferences and demographic changes fundamentally reshape industries. Understanding evolving consumer needs is critical for sustained success in any industry. Companies that accurately anticipate and respond to changing preferences often increase their market share and profitability, positively impacting the financial standing of associated individuals. Conversely, companies that fail to adapt to changing preferences can experience declining revenues, impacting an individual's financial success. Examining demographic shifts and evolving consumer tastes is essential for evaluating the future prospects of industries.

In summary, industry trends are integral components in evaluating an individual's financial success. Assessing how these trends evolve and shape the industry is crucial for understanding their influence on an individual's overall financial position. Factors like innovation, globalization, economic conditions, and consumer preferences all contribute to the fluctuating landscape, ultimately impacting an individual's financial standing and thus, the calculation of their "net worth."

8. Public Perception

Public perception plays a significant role in shaping the perceived value or "net worth" of individuals, particularly those in the public eye. While not a direct, quantifiable factor in financial calculations, public opinion can influence investor confidence, brand valuation, and even perceived market worth. This analysis explores the impact of public opinion on the overall perception of a person's financial standing.

- Brand Valuation and Recognition

Public recognition and positive brand image can increase perceived value. A highly respected or admired individual often commands greater perceived worth than someone less known. For example, a celebrity chef with a strong culinary brand and positive media coverage might have a higher perceived market value than a less-recognized chef, even if their actual income and assets are similar. This elevated reputation can create a "halo effect," influencing how potential investors or partners view the individual and their associated projects.

- Investor Confidence and Market Sentiment

Public perception of an individual's character, business practices, and future potential can impact investor confidence. Positive public opinion can attract investment, fostering a sense of security and encouraging financial partnerships. Conversely, negative perceptions can deter investors and lower the perceived value of assets associated with the individual. This impact is evident in the stock market, where company reputations and leadership credibility play a crucial role in investor decisions.

- Media Representation and Publicity

Media coverage significantly shapes public perception. Favorable media portrayals can boost an individual's image and attract attention, often leading to an increased perceived market value. This can be seen in the entertainment industry, where media hype can drive demand for an actor or musician. However, unfavorable or negative media coverage can damage reputation and diminish an individual's perceived worth. The overall tone and portrayal in media can affect a person's perceived image and future prospects.

- Social Impact and Philanthropy

Public perception of philanthropic efforts and positive social impact can enhance a person's perceived value. Individuals with a history of contributing positively to society, or engaging in charitable work, often gain a favorable public image. This positive reputation can attract investment, business opportunities, and partnerships, boosting the perceived value and influence of that individual. The perception of a person's social contribution is a significant component, influencing overall esteem.

In conclusion, while public perception isn't a direct measure of financial worth, it significantly influences the perceived value of an individual. A positive public image can attract investment, enhance brand reputation, and increase an individual's perceived overall worth. Conversely, negative perception can deter partnerships, diminish brand value, and lower the perceived financial standing. Therefore, maintaining a positive and credible public image is crucial for maximizing perceived value, regardless of an individual's actual financial standing.

Frequently Asked Questions about "Toriyama Net Worth"

This section addresses common inquiries regarding the financial standing of Toriyama. The following answers aim to provide clarity and accurate information, avoiding speculation or conjecture.

Question 1: How is "Toriyama net worth" determined?

Determining an individual's net worth involves a comprehensive assessment of assets and liabilities. This typically includes evaluating the value of tangible assets like real estate, investments, and personal collections, along with the extent of outstanding debts. Reliable sources such as financial disclosures, public records, and professional valuations form the basis of such estimates. Importantly, estimates may vary among different sources due to the complexity of such calculations. Direct confirmation of figures is often unavailable.

Question 2: What factors influence the estimated "Toriyama net worth"?

Several factors can influence estimated net worth, including income sources, such as salaries, investment returns, business revenue, and intellectual property rights. Asset values fluctuate based on market conditions, influencing the overall valuation. Significant changes in income, investment performance, or debt levels directly impact the estimated net worth. The nature and magnitude of these variables contribute to the overall financial picture.

Question 3: Is public perception a factor in estimating "Toriyama net worth"?

Public perception, while not a direct determinant of financial worth, can influence how the market or investors perceive an individual's financial standing. Favorable public image can increase perceived value, while negative perceptions can have the opposite effect. However, this impact is indirect and doesn't directly translate into numerical calculations of net worth.

Question 4: Can "Toriyama net worth" be accurately verified?

Verifying an exact "Toriyama net worth" is often difficult. While public records and financial statements can offer valuable insights, complete and definitive confirmation is typically unavailable to the public. Estimation methods are often employed due to the complex factors involved and the lack of direct access to personal financial information.

Question 5: Why is understanding "Toriyama net worth" relevant?

Understanding how financial standing is assessed, and the factors influencing it, is relevant for a broader perspective. This analysis highlights economic trends, industry performance, and the interplay between individual success and broader economic forces. While specifics about "Toriyama net worth" may remain unclear, the methodology and considerations applicable provide a valuable understanding of wealth calculation in general. It encourages a nuanced understanding of individual economic success and the overall financial ecosystem.

This concludes the frequently asked questions. Further details and analysis on the topic may be available in subsequent sections.

Conclusion

The exploration of "Toriyama net worth" reveals a complex interplay of factors influencing an individual's financial standing. Income sources, including salary, investments, and potential business revenue, play a crucial role. Asset valuation, encompassing real estate, investments, and other holdings, is equally critical. Fluctuations in market conditions, industry trends, and public perception further complicate the estimation process. The analysis highlights the intricate relationship between personal financial decisions, economic forces, and external influences in shaping an individual's overall financial standing. While precise figures remain elusive, the examination underscores the complexities and nuances involved in evaluating an individual's economic position.

Ultimately, the pursuit of understanding "Toriyama net worth," or any individual's financial status, necessitates a comprehensive and nuanced approach. Precise figures are often elusive, yet the analysis provides a framework for understanding the intricate components that contribute to an individual's economic success. Further study into specific industries, economic trends, and individual financial strategies could yield deeper insights into the factors influencing wealth accumulation. A profound comprehension of these dynamics is critical to understanding the broader economic landscape and its impact on individual well-being.

Article Recommendations

- The Gossip Wire Your Ultimate Source For Celebrity News

- Has Post Malone Been Arrested A Comprehensive Look Into The Rappers Legal Troubles

- Understanding The Duration Of The Simon And Garfunkel Story