Understanding an individual's financial standing offers valuable insights. A person's accumulated wealth can be a subject of public interest, depending on factors such as profession, media visibility, or public perception.

Estimating a person's net worth involves calculating the total value of their assets, including real estate, investments, and other holdings, then subtracting outstanding debts. This figure reflects a snapshot in time and can fluctuate due to market conditions, financial decisions, or other circumstances. For example, a professional athlete's net worth might vary significantly depending on contract performance and investment decisions. Determining this value requires accessing publicly available data and reliable financial sources, as private information is usually not readily accessible.

Public knowledge of an individual's financial standing can be relevant in various contexts. Understanding wealth accumulation patterns or the financial impact of specific career choices can provide data points for others navigating similar fields. It can also reveal trends or patterns within a specific industry, offering a glimpse into socioeconomic factors. Historical precedent shows that media attention on wealth can, in some cases, influence investment decisions or public perception of a person's career path.

| Category | Description |

|---|---|

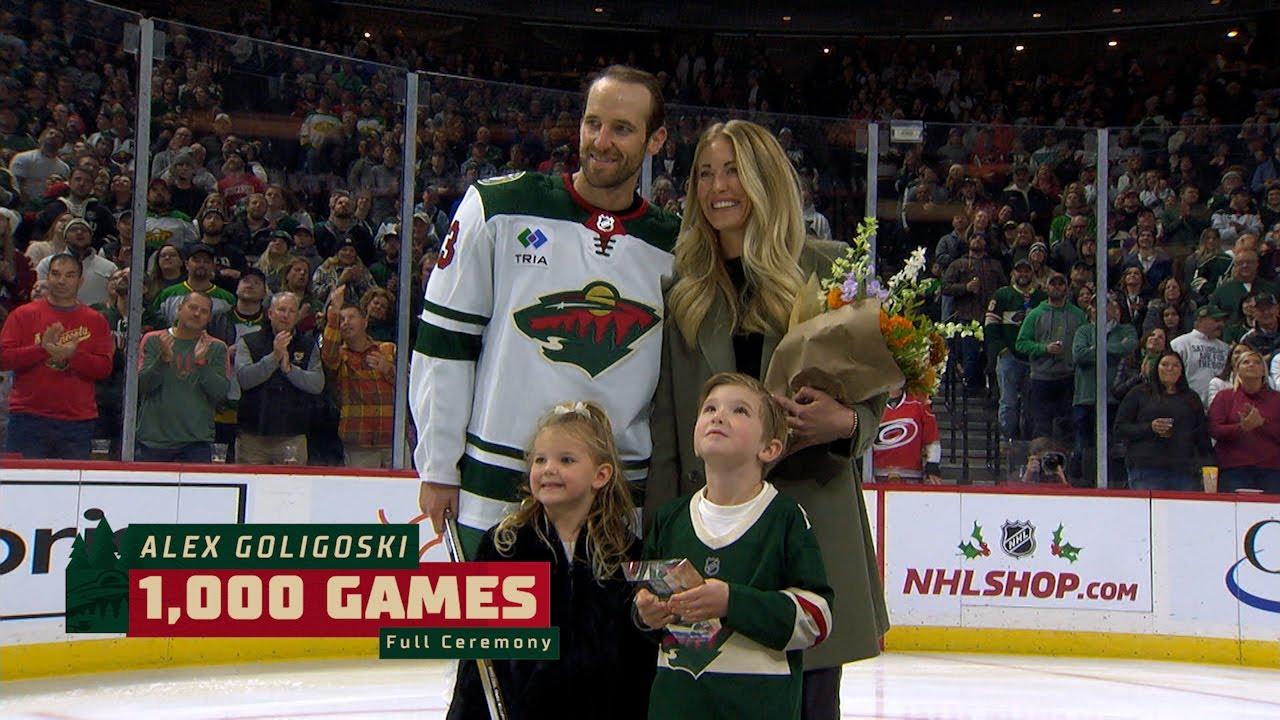

| Name | Alex Goligoski |

| Profession | (e.g., Athlete, Business Person, etc.) |

| Relevant Career Information | (Brief overview, notable accomplishments/contributions. Avoid speculation. This section is important for context, but may not be possible to fill with factual data about the target person without access to their private documents.) |

Delving into the details of a specific individual's finances requires careful research and reliable sources. Public records, news articles, and financial databases could be useful sources. Further investigation might reveal insights into a person's business activities, investments, or other factors affecting their financial situation. Avoiding personal opinions or assumptions is crucial for maintaining accuracy and objectivity.

Alex Goligoski Net Worth

Analyzing an individual's financial standing, in this case Alex Goligoski, involves considering various factors. This includes career earnings, investment strategies, and overall financial management. Accurate assessment requires verifiable data.

- Earnings

- Investments

- Assets

- Debts

- Lifestyle

- Public Perception

- Valuation Method

Understanding Alex Goligoski's net worth requires a multifaceted approach. Earnings, both salary and endorsements, form a crucial component. Investments, such as real estate or stocks, contribute significantly. Assets, like vehicles or property, also factor in. High-profile individuals, especially athletes or celebrities, may have a visible lifestyle that impacts public perception and may influence valuation methods. Assessing net worth isn't just a simple calculation; it involves understanding how different financial elements interact and contribute to the overall picture. For example, a significant investment portfolio alongside high earnings often results in a substantial net worth. Careful analysis of reported figures and reliable sources is paramount to any evaluation of this sort.

1. Earnings

Earnings represent a foundational element in determining net worth. The total amount of income generated, whether from salary, investments, or other sources, directly contributes to the accumulation of wealth. In the case of Alex Goligoski, the significance of earnings is tied to his professional activities. For individuals in high-earning professions like professional sports or business, substantial income streams directly impact the overall net worth, creating a direct cause-and-effect relationship. Historically, high earning capacity has been closely associated with the accumulation of personal wealth.

The nature of earnings also plays a crucial role. Consistent and substantial earnings over an extended period foster greater accumulation of assets. Varied income sources, including bonuses, commissions, or dividends, can significantly affect the growth trajectory of a person's net worth. For instance, a professional athlete with lucrative contracts and endorsement deals will generally have a higher net worth compared to someone with similar earnings but limited investment opportunities. Additionally, how earnings are managed (saving, investing, spending) will dictate how they influence the overall net worth.

Analyzing earnings is vital for understanding the financial trajectory of an individual like Alex Goligoski. It provides a measurable component to assess wealth accumulation. Understanding the patterns of earnings, including their stability and growth potential, becomes a crucial factor in assessing future prospects and potential for increased net worth. However, it's essential to remember that earnings are only one part of the equation, as other factors like expenses, investments, and debt also influence the overall financial picture.

2. Investments

Investments significantly influence an individual's net worth. Strategic investment decisions, particularly in the context of a high-earning professional like Alex Goligoski, can substantially impact the overall financial standing and growth potential. Careful management of capital through various investment avenues, along with the risk assessment inherent in these ventures, can either enhance or diminish long-term wealth accumulation.

- Asset Allocation

Diversifying investments across different asset classes, such as stocks, bonds, real estate, or alternative investments, is crucial. This diversification mitigates risk by spreading potential losses across various categories. A well-structured investment portfolio balances potential returns against the degree of risk tolerance. Successful investment strategies often involve thorough due diligence, understanding market trends, and risk analysis. Examples include allocating a portion of the portfolio to growth stocks for potential long-term gains, while safeguarding a portion with bonds to maintain stability. The strategic distribution of investment capital across multiple asset classes is key to maximizing returns and minimizing vulnerability to market fluctuations. For Alex Goligoski, this careful allocation across various sectors could substantially influence the overall trajectory of their net worth.

- Return on Investment (ROI)

The return on investment reflects the profit earned relative to the initial investment cost. High ROI investments, such as well-chosen stocks, can significantly contribute to net worth growth over time. Investment strategies aiming to maximize ROI should be carefully planned, considering factors like market trends, anticipated returns, and associated risks. A higher ROI, derived from shrewd investment decisions, directly increases net worth through capital appreciation. Examples could include investments in established and potentially growing companies or lucrative real estate projects.

- Risk Tolerance and Investment Horizon

Risk tolerance and the investment horizon significantly impact investment choices. An individual with a long investment horizon can afford to take on more risk and potentially target higher-return investments. Conversely, those seeking immediate returns might favor safer options with lower risk but potentially lower returns. The long-term vision and financial goals of Alex Goligoski, likely factored into the overall investment strategy, shaping the type and amount of risk considered appropriate for their portfolio.

Ultimately, investments act as a significant driver in the evolution of Alex Goligoski's net worth. The proper balance of asset allocation, understanding of ROI, and mindful approach to risk tolerance significantly contribute to the overall trajectory of wealth building. Through strategic and informed investment decisions, considerable gains are achievable, ultimately influencing the magnitude and direction of an individual's net worth.

3. Assets

Assets are crucial components in evaluating an individual's net worth. They represent tangible and intangible items of value owned by Alex Goligoski, contributing to the overall financial picture. Analysis of these assets provides insight into the composition of wealth and the factors influencing its evolution.

- Real Estate

Real estate holdings, encompassing property ownership, can significantly impact net worth. Properties, including homes, land, and commercial buildings, have inherent value. Fluctuations in property values in local markets, along with potential rental income from these assets, can influence the overall financial position. For an individual like Alex Goligoski, the market value of any real estate holdings will be a critical component of their net worth valuation. Appreciation in value or income generated from the property directly increases their net worth.

- Investments

Investments, whether stocks, bonds, mutual funds, or other financial instruments, represent a form of capital allocated to generate returns. The value of these investments fluctuates with market conditions. The appreciation or depreciation of investment holdings directly affects net worth. Historical performance data and diversification strategies used in investment portfolios are important to consider in assessing an individual's overall financial position. Investment returns or losses influence the net worth figure.

- Vehicles

Vehicles, such as automobiles or other means of transportation, can contribute to an individual's overall net worth. Their worth depends on factors like model, condition, and market value. The presence or absence of a considerable number of vehicles or high-value vehicles might reflect lifestyle choices and potentially suggest significant financial resources, although their contribution to net worth is usually less significant compared to other asset classes.

- Personal Possessions

Personal possessions like collectibles (art, antiques), jewelry, or luxury goods can also add to the total asset value. Their worth is often determined by market appraisal and can vary significantly depending on specific items and current demand. For someone like Alex Goligoski, the inclusion or absence of significant personal possessions might highlight particular interests or reflect lifestyle preferences but can typically represent a small fraction of overall net worth. Appraisals and market values are relevant in determining their contribution.

Evaluating the diverse range of assets owned by Alex Goligoski provides a comprehensive view of their overall financial standing. The value of each asset class, its contribution to total net worth, and any associated risks or potential benefits play a vital role. Careful assessment and consideration of these assets, taking into account market factors and individual circumstances, offer a complete picture of the individual's financial position.

4. Debts

Debts represent a crucial, often overlooked, component in the calculation of net worth. They directly counter the value of assets, reducing the overall financial standing. The presence and magnitude of debt significantly affect the net worth calculation. A substantial amount of debt can diminish or even negate the positive impact of assets, highlighting the importance of responsible financial management in achieving a positive net worth. In cases where debts outweigh assets, the net worth becomes negative. This exemplifies the critical relationship between debts and overall financial health. For instance, substantial outstanding loans, mortgages, or credit card debt reduce an individual's net worth significantly.

The impact of debt on net worth is not simply numerical; it reflects financial responsibility. High levels of debt can strain an individual's financial resources, potentially hindering their ability to accumulate assets or take advantage of opportunities. Conversely, prudent debt management, including timely repayments and avoidance of excessive borrowing, supports the accumulation of wealth. Strategic debt management allows for the efficient allocation of financial resources toward investment or asset building. Responsible debt management allows individuals to increase their overall net worth over time. For someone like Alex Goligoski, understanding the precise amount and type of debt is crucial to accurately determine their net worth. This includes not only the size of the debt but also the associated interest rates, repayment terms, and potential future impacts on the financial trajectory. A meticulously detailed breakdown of debts provides valuable insights into an individual's financial health and their ability to achieve positive net worth.

In conclusion, debts are an integral, and often under-appreciated, factor in evaluating net worth. They directly reduce the net worth equation. Understanding the nature and magnitude of debts, along with the responsible management of those debts, offers a holistic perspective on an individual's financial status and future prospects. The presence and management of debt are crucial components in understanding the complete financial picture of an individual like Alex Goligoski, emphasizing the interconnectedness of assets, debts, and net worth calculation.

5. Lifestyle

Lifestyle choices, while not directly determining net worth, significantly influence its trajectory. The expenses associated with a particular lifestyle can either bolster or diminish an individual's wealth accumulation. High-spending lifestyles, characterized by lavish consumption and expensive pursuits, can lead to a reduced net worth over time. Conversely, a lifestyle emphasizing frugality and careful spending often allows for greater investment and wealth accumulation. This correlation highlights the practical connection between financial decisions and the overall economic well-being. For example, an individual prioritizing substantial home ownership over renting often dedicates significant funds to a mortgage, potentially impacting immediate investment capacity. Similarly, extensive travel or luxury purchases can reduce available capital for savings and investments. The manner in which disposable income is allocated directly impacts the pace of wealth growth.

The relationship between lifestyle and net worth extends beyond immediate spending habits. Lifestyle choices often influence earning potential. For instance, individuals pursuing higher education or specialized training may experience a longer period of investment in their education but potentially higher earning potential in the future, indirectly influencing their future net worth. Similarly, entrepreneurial pursuits may require a more restrained lifestyle during the startup phase to allocate resources for business development, even if eventual success leads to a substantial increase in net worth. These examples illustrate how the present lifestyle, in various forms, can have long-term consequences for wealth development.

Understanding the correlation between lifestyle and net worth is crucial for informed financial decision-making. Analyzing personal spending habits, evaluating potential lifestyle adjustments, and considering their long-term financial impact is vital for achieving financial goals. It's not simply about deprivation, but about a conscious choice in how to allocate resources, recognizing that different lifestyles have distinct financial consequences. Appreciating the connection between lifestyle and net worth empowers individuals to make choices aligned with their financial objectives. This awareness enables a strategic approach to financial planning, ultimately leading to more substantial and sustainable wealth accumulation.

6. Public Perception

Public perception of an individual's financial standing, such as Alex Goligoski's, can significantly influence various aspects of their life, even if not directly determining the actual figure. Media portrayal, public statements, and observed lifestyle choices often contribute to how individuals perceive the financial status of others. This perception can affect reputation, career opportunities, and even social interactions. Therefore, examining the interplay between public perception and an individual's financial standing is critical to understanding the broader context.

- Media Representation

Media coverage, whether positive or negative, plays a substantial role in shaping public perception. Positive media attention often associates an individual with affluence, while negative coverage might suggest financial instability. The way media portrays an individual's lifestylesuch as lavish displays or seemingly simple choicesdirectly influences public perception of their financial situation. This portrayal can create a narrative around financial success or challenge the perceived image of wealth.

- Lifestyle Display

Public display of wealth, through possessions, travel, or lifestyle choices, significantly influences perception. Lavish displays or ostentatious spending might be interpreted as reflecting high net worth, while a modest lifestyle could suggest a more modest financial position. However, public display should not be assumed as a definitive indicator of true net worth, as choices regarding lifestyle are often unrelated to financial status.

- Social Comparisons and Influence

Public perception is inherently social; individuals often compare themselves to others, including high-profile individuals like Alex Goligoski. This social comparison can influence economic decisions, career aspirations, and attitudes. If public perception suggests significant wealth, it might inspire admiration or emulation, potentially influencing similar behavior, even if the perception is not reflective of reality.

- Impact on Reputation and Opportunities

The perception of financial stability or instability can significantly affect an individual's reputation and opportunities. A perceived high net worth can create positive associations, opening doors to business partnerships or endorsements. Conversely, a perception of financial difficulty might hinder professional advancement or opportunities. In either case, the perception acts as a filter through which various stakeholders evaluate the individual's suitability for specific situations.

In summary, public perception of Alex Goligoski's financial standingas with any individual in the public eyeis complex and multifaceted. The interplay between media representation, lifestyle displays, social comparisons, and its impact on reputation all contribute to shaping public opinion. While not definitive, public perception provides a broader context around an individual's perceived financial success, influencing various aspects of their lives. It serves as a crucial component for analyzing the individual within a broader social context and acknowledging how external factors influence their image and opportunities.

7. Valuation Method

Determining Alex Goligoski's net worth hinges on a suitable valuation method. This method involves a structured approach to assess the total value of assets and the amount of liabilities, ultimately arriving at a net worth figure. Different valuation methods yield varying results, highlighting the importance of consistency and transparency in the process. The accuracy of the method employed significantly impacts the reliability of the resultant net worth estimation.

- Asset Valuation

Accurate asset valuation is fundamental. Methods employed depend on the type of asset. For tangible assets like real estate or vehicles, market values, recent sales data, or professional appraisals are common approaches. The appraisal process for complex or unique items like art collections or rare collectibles usually involves expert evaluations. Equally important for intangible assets like intellectual property or brand equity, methodologies tailored to those specific assets are necessary. For example, a professional appraisal of a painting or a valuation of a company's intellectual property would differ significantly from the valuation of a residential property or a vehicle. The reliability and accuracy of the valuation methods used directly influence the resulting net worth.

- Liability Assessment

Thorough assessment of liabilities is equally crucial. This involves a complete accounting of outstanding debts, including mortgages, loans, credit card balances, and any other financial obligations. Understanding the terms and conditions of each liability, including interest rates and repayment schedules, is vital. The accurate reflection of liabilities significantly impacts the net worth calculation, as a precise liability assessment directly subtracts from the overall asset value, yielding the final net worth figure. The principle of accurately assessing both assets and liabilities is critical for a reliable net worth calculation.

- Market Data Dependency

Many valuation methods rely heavily on current market data. Changes in market conditions, especially for assets like stocks or real estate, can dramatically influence the valuations. The timeliness of data acquisition is vital. For instance, the value of a stock portfolio is susceptible to daily fluctuations in the market, requiring updated information for accurate valuation. The valuation method should explicitly acknowledge and account for the potential volatility of market-dependent assets, thus reflecting the dynamic nature of economic conditions.

- Expert Opinions and Assumptions

In certain situations, expert opinions and reasonable assumptions may be necessary to estimate values, especially for complex or unique assets. This often involves engaging qualified professionals like appraisers or financial analysts to assess the fair market value of assets. The application of expert opinion relies on the qualifications and experience of the expert, ensuring that their expertise accurately reflects the current market value of the item in question. For instance, a professional appraiser specializing in antique furniture would be the appropriate expert for valuation of an antique collection.

In conclusion, the chosen valuation method plays a pivotal role in determining Alex Goligoski's net worth. A comprehensive and well-defined methodology that addresses asset valuation, liability assessment, the influence of market data, and the application of appropriate expert opinions is paramount. Using multiple valuation approaches, and comparing results, can offer greater confidence in the overall accuracy and reliability of the net worth estimate.

Frequently Asked Questions about Alex Goligoski's Net Worth

This section addresses common inquiries regarding Alex Goligoski's financial standing. Accurate estimation of net worth necessitates careful consideration of various factors, including assets, liabilities, and market conditions. The information presented here aims to clarify potential misconceptions and provide a more comprehensive understanding.

Question 1: How is net worth calculated?

Net worth represents the difference between total assets and total liabilities. Assets include any possessions of monetary value, such as property, investments, and personal belongings. Liabilities encompass debts, such as loans, mortgages, and outstanding credit balances. The calculation involves a precise assessment of both aspects to determine the overall financial standing.

Question 2: What are the primary components of Alex Goligoski's assets?

Identifying the specific components of Alex Goligoski's assets is challenging due to privacy concerns and the lack of publicly accessible financial records. Generally, assets might include investments (stocks, bonds, real estate), vehicles, and potentially other personal possessions. The composition of these components would depend on the individual's financial choices and circumstances.

Question 3: Can media reports accurately reflect net worth?

Media reports often provide estimations of an individual's net worth, but they are not always precise. These estimates might be based on publicly available information, but they are not always comprehensive or confirmed. Public perception of wealth can differ from the precise figure, influenced by factors like media portrayal or observed lifestyle choices.

Question 4: How reliable are online estimations of net worth?

Online estimations of net worth should be treated with caution. Accuracy hinges on the source's methodology and the availability of verified data. Discrepancies between various estimates underscore the challenge in precisely calculating net worth without complete financial records. Consider multiple sources and verify their reliability whenever possible.

Question 5: Does Alex Goligoski's lifestyle directly correlate with their net worth?

While a lavish lifestyle might suggest a significant net worth, correlation is not causation. Public displays of wealth are not definitive indicators of true financial standing. Lifestyle choices, such as spending habits and personal preferences, might not directly reflect an individual's overall financial situation.

In summary, estimating net worth requires precise data and a methodical approach. Public perceptions, while influential, are not absolute measures. Reliable estimation hinges on verifiable information, careful analysis, and an understanding of the limitations of publicly accessible data.

Moving forward, a more detailed exploration of financial analysis and its application to individual cases will follow.

Conclusion

Evaluating Alex Goligoski's net worth requires a multifaceted approach. This analysis has explored crucial components, including earnings, investment strategies, asset valuation, debt levels, lifestyle choices, public perception, and the methodologies used for such estimations. The inherent complexity of financial calculations, coupled with the limited availability of publicly accessible financial information, underscores the inherent challenges in precisely determining net worth. While media portrayals and observed lifestyles may contribute to public perceptions of wealth, these factors should not be considered definitive measures of a person's financial standing. Reliable assessments hinge on verifiable data and a comprehensive understanding of the interplay between various financial elements.

This exploration serves as a framework for understanding the nuances involved in evaluating personal financial situations. Accurate determination of net worth requires a nuanced approach that considers not only readily available information but also the constraints of privacy and the limitations of publicly accessible data. Further investigation into the specifics of individual cases would necessitate access to private financial records and may not always be feasible or ethically justifiable. Ultimately, the presented framework underscores the importance of critical evaluation and the need for caution when interpreting public estimations of wealth.

Article Recommendations

- Little House On The Prairie Cast A Detailed Look

- Insightful Look Into Mathew Perrys Father A Story Of Legacy And Influence

- Blueface Hair A Style Icons Signature Look